NO.PZ202206260100000302

问题如下:

Which of Chang’s observations about Fund A is most likely accurate?选项:

A.Observation 1 B.Observation 2 C.Observation 3解释:

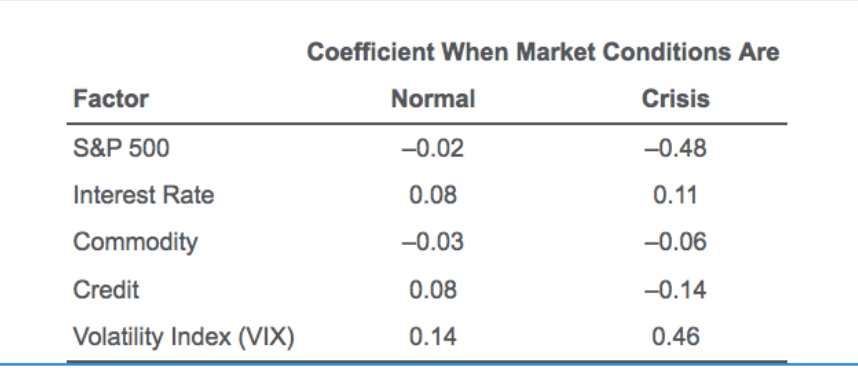

SolutionC is correct. For Fund A, adding deep out-of-the-money puts during periods of market stress would explain why the correlation with equity markets is relatively neutral in normal markets but is significantly negative during periods of crisis. It also is supported by a large increase in positive correlation with volatility during periods of crisis.

A is incorrect. Fund A does not likely have a dedicated short bias strategy because the sensitivity to equity markets is essentially zero except for during times of crisis.

B is incorrect. Fund A has a positive exposure to volatility through the VIX, especially during periods of market stress. This is not indicative of a manager selling puts against short positions.

都是什么意思,谢谢