NO.PZ2018122701000073

问题如下:

For a 2-year zero-coupon bond, the 1-year rate is expected to remain at 5% for the first year. For the second year, it is foretasted the that 1-year spot rate will be either 7% or 3% at equal probability of 50%. If you are asked to reflect the convexity effect for this 2-year bond by Jensen’s inequality formula, which of the following inequalities is the best answer?

选项:

A.$0.90736 > $0.90703.

B.$0.90703 > $0.90000.

C.$0.95238 > $0.90736.

D.$0.95273 > $0.95238

解释:

A is correct.

考点:Jensen's inequality formula

解析:

不等式左边

0.95273/1.05 = 0.90736

不等式右边

0.95238/1.05 = 0.90703

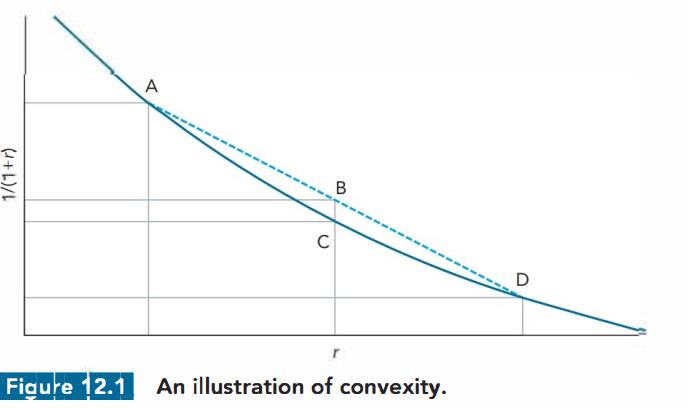

右边等式应该是 1/Er=1/E(1+r)但是 这1/E(1+r)应该怎么理解啊 李老师讲的时候我就没听懂 就是