NO.PZ2016012101000065

问题如下:

For 2009, Flamingo Products had net income of $1,000,000. At 1 January 2009, there were 1,000,000 shares outstanding. On 1 July 2009, the company issued 100,000 new shares for $20 per share. The company paid $200,000 in dividends to common shareholders. What is Flamingo’s basic earnings per share for 2009?

选项:

A.$0.80.

B.$0.91.

C.$0.95.

解释:

C is correct.

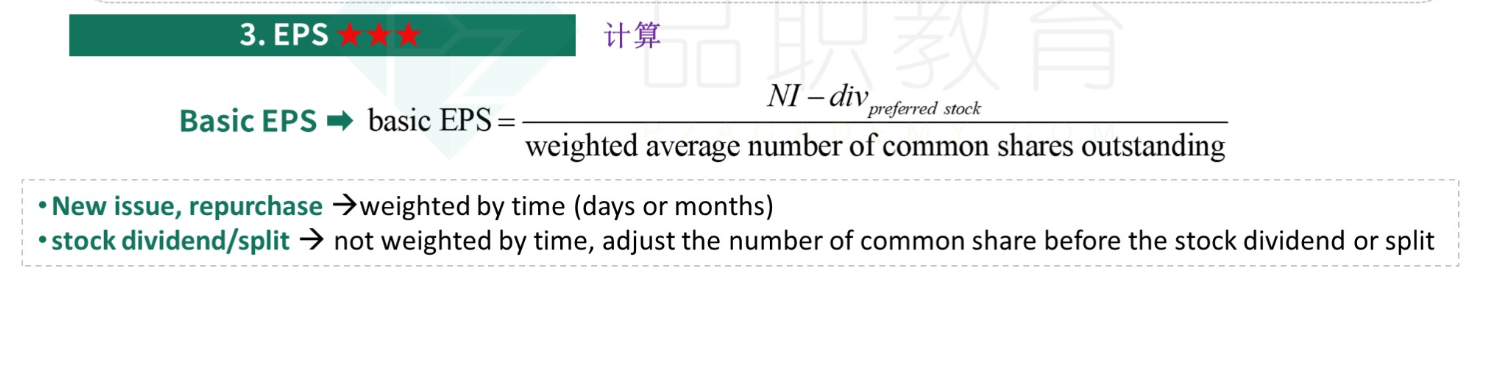

The weighted average number of shares outstanding for 2009 is 1,050,000. Basic earnings per share would be $1,000,000 divided by 1,050,000, or $0.95.

解析:basic EPS=(NI-给优先股的分红)/weighted average number of common shares outstanding。这题没有给优先股的分红,分子就等于净利润$1,000,000。分母= 1,000,000*(12/12)+ 100,000*(6/12)= 1,050,000,basic EPS=$1,000,000/1,050,000=$0.95。

On 1 July 2009, the company issued 100,000 new shares for $20 per share这个是以20美金法益股的话为什么不20✖100,000呢