NO.PZ2021062201000003

问题如下:

A two-stock portfolio includes stocks with the following characteristics:

What is the standard deviation of portfolio returns?

选项:

A.14.91%

B.18.56%

C.21.10%

解释:

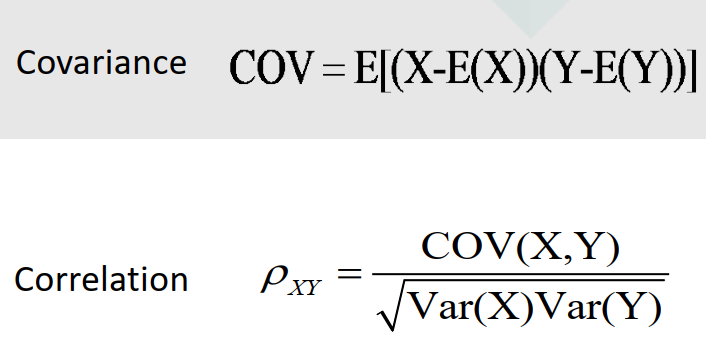

B is correct. The covariance between the returns for the two stocks is

Cov (R1,R2) = ρ (R1,R2) σ (R1) σ(R2) = 0.20 (12) (25) = 60.

The portfolio variance is:

=(0.30)2(12)2+(0.7)2(25)2+2(0.30)(0.70)(60)

=12.96 +306.25 +25.2

=344.41

The portfolio standard deviation is:

知识点:Probability Concepts

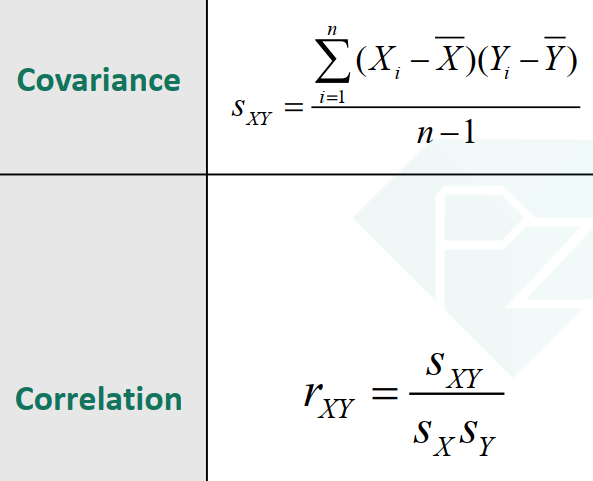

我有点迷糊CV和COV的区别,可以麻烦解释下吗?