NO.PZ201803130100000203

问题如下:

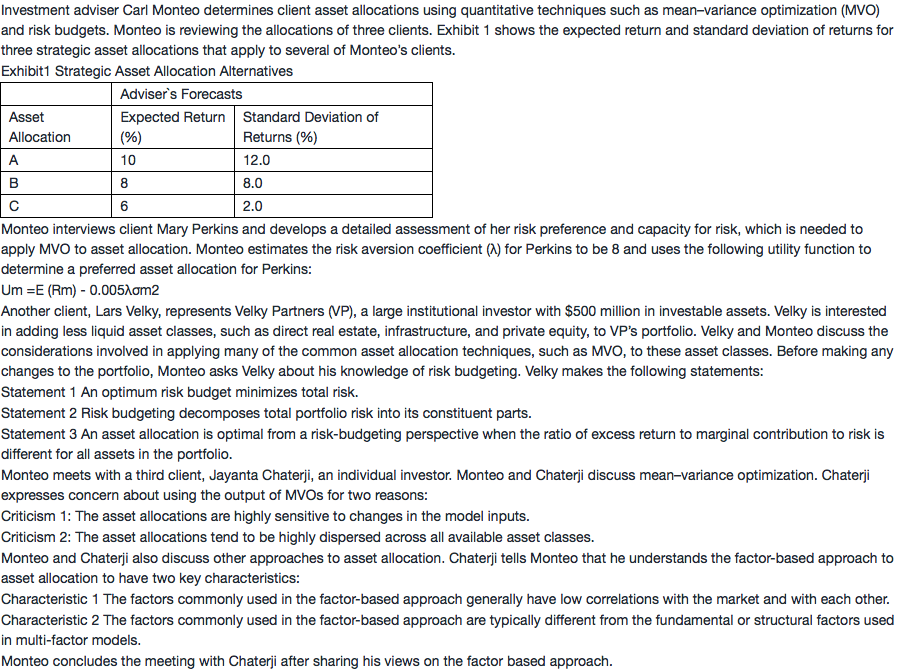

Which of Velky’s statements about risk budgeting is correct?

选项:

A.Statement 1

B.Statement 2

C.Statement 3

解释:

B is correct.

The goal of risk budgeting is to maximize return per unit of risk. A risk budget identifies the total amount of risk and attributes risk to its constituent parts. An optimum risk budget allocates risk efficiently.

statement3如何理解