NO.PZ201710200100000202

问题如下:

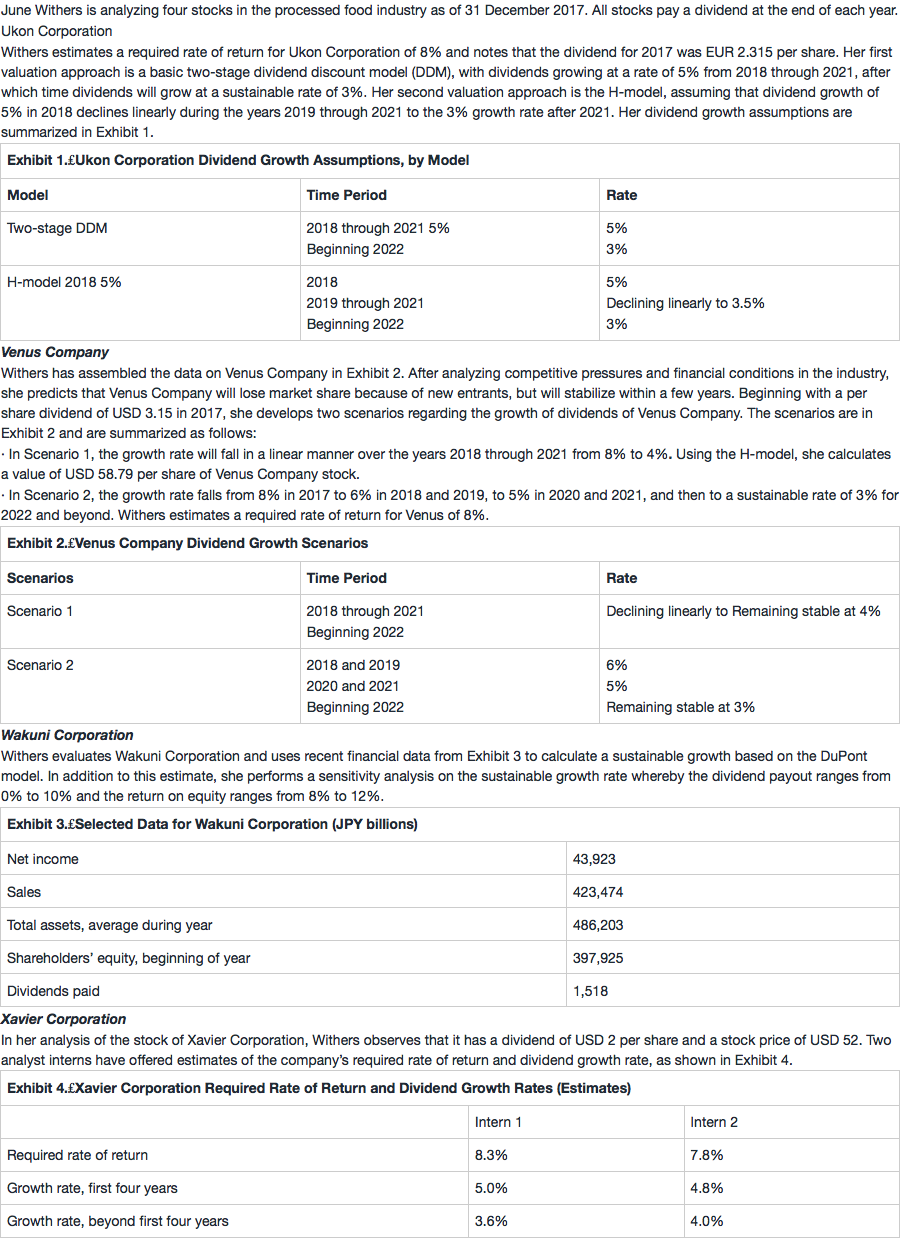

2. Using her first valuation approach and Exhibit 1, Withers’s forecast of the per share stock value of Ukon Corporation at the end of 2017 should be closest to:

选项:

A.EUR 48.

B.EUR 50.

C.EUR 51

解释:

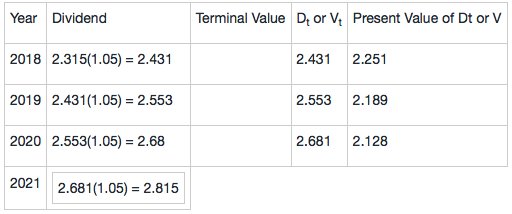

C is correct based on Withers’s assumptions applied to the dividend valuation model. The stock value as of the end of 2017 equals the present value of all future dividends in 2018 through 2021 plus the present value of the terminal value at the end of 2021. The forecasted stock value equals EUR 51.254:

60.795

44.686

2022

2.815(1.03) = 2.899

Total

51.254

The terminal value at the end of 2021 is calculated using the dividend in the first year beyond the first stage, divided by the difference between the required rate of return and the growth rate in the second stage.

Terminal value at end of 2021 = 2.815*(1.03)/ ( 0.08−0.03 ) =57.980

这题的答案我有点蒙,我算是2.315/1.08+2.315/1.08^ 2+。。。+(2.315*(1.05^ 4)(1.03)/(0.08-0.03)),跟答案里的不一样,答案里每年div都在三年基础上乘,这个和我这种说法的区别点在哪里?