NO.PZ2021120102000028

问题如下:

Which of the following statements best describes a credit curve roll-down strategy?

选项:

A.Returns from a credit curve roll-down strategy can be estimated by

combining the incremental coupon from a longer maturity corporate bond with price appreciation due to the passage of time.

A synthetic credit curve roll-down strategy involves purchasing protection using a single-name CDS contract for a longer maturity.

A credit curve roll-down strategy is expected to generate a positive return if the credit spread curve is upward sloping.

解释:

C is correct. A credit curve roll-down strategy will generate positive return only under an upward-sloping credit spread curve.

As for A, the benchmark yield changes must be separated from changes due to credit spreads, and under B, a synthetic credit roll-down strategy involves selling protection using a single-name CDS contract for a longer maturity.

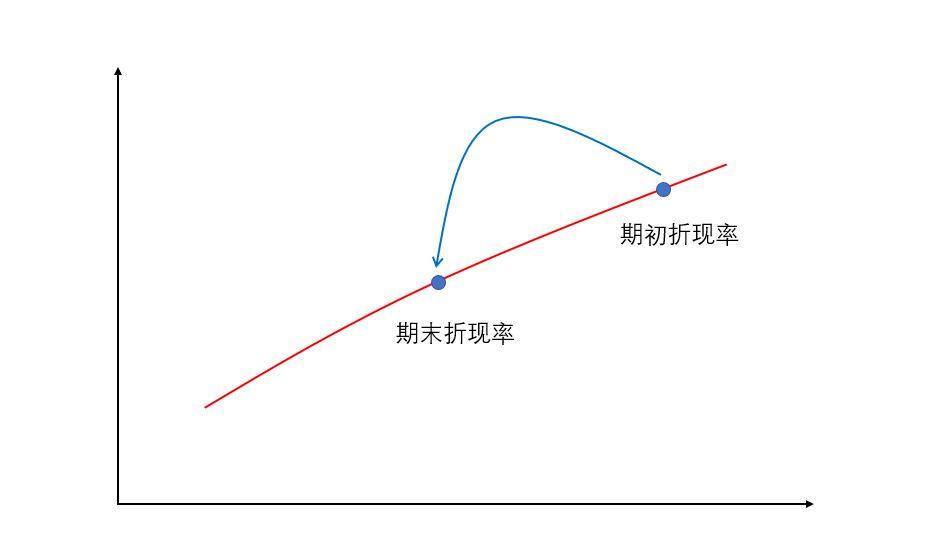

如果是spread upward sloping的话,那spread未来会上涨,则CDS应该是下降,那不是会亏钱吗??麻烦老师解释一下