NO.PZ2017102901000017

问题如下:

For its fiscal year-end, Calvan Water Corporation (CWC) reported net income of $12 million and a weighted average of 2,000,000 common shares outstanding. The company paid $800,000 in preferred dividends and had 100,000 options outstanding with an average exercise price of $20. CWC’s market price over the year averaged $25 per share.CWC’s diluted EPS is closest to:

选项:

A.$5.33.

B.$5.54.

C.$5.94.

解释:

B is correct.

The formula to calculate diluted EPS is as follows:

Diluted EPS = (Net income – Preferred dividends) / [Weighted average number of shares outstanding + (New shares that would have been issued at option exercise–Shares that could have been purchased with cash received upon exercise) × (Proportion of year during which the financial instruments were outstanding)].

The underlying assumption is that outstanding options are exercised, and then the proceeds from the issuance of new shares are used to repurchase shares already outstanding:

Proceeds from option exercise = 100,000 × $20 = $2,000,000

Shares repurchased = $2,000,000/$25 = 80,000

The net increase in shares outstanding is thus 100,000 – 80,000 = 20,000. Therefore, the diluted EPS for CWC = ($12,000,000 – $800,000)/2,020,000 = $5.54.

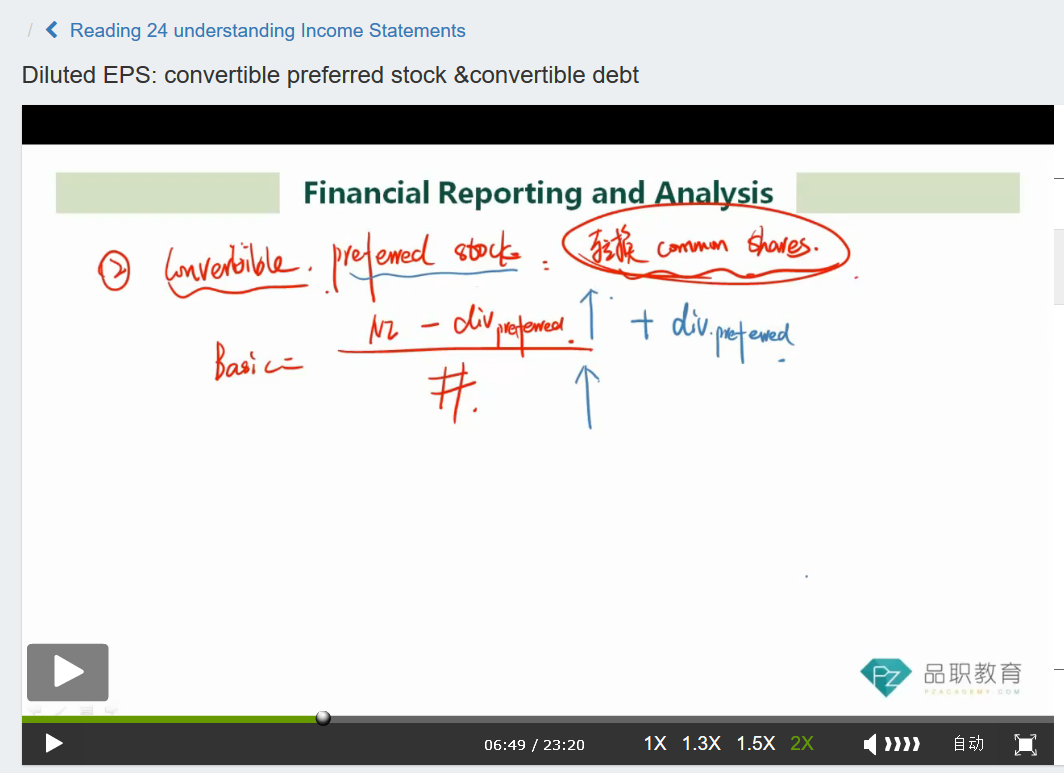

损益表里面的NI 不是已经剔除了优先股股利了吗? 这里为什么还要减去?