NO.PZ201512300100001207

问题如下:

7. Under Scenario 1, the intrinsic value per share of the equity of Amersheen is closest to:

选项:

A.R13.29.

B.R15.57.

C.R16.31.

解释:

As the multistage residual income model results in an intrinsic value of R16.31.

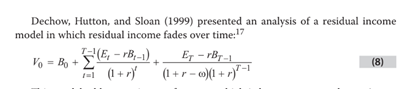

This variation of the multistage residual income model, in which residual income fades over time, is:

where

The first step is to calculate residual income per share for years 2012

ROE = earnings / book value

Growth rate = ROE × retention rate

Retention rate = 1

Book valuet= book valuet

Residual income per share = EPS

Equity charge per share = book value per sharet× cost of equity

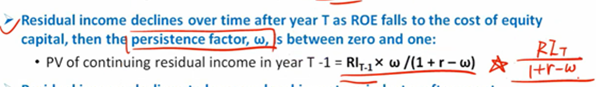

Using the residual income per share for 2015 of R1.608, the second step is to calculate the present value of the terminal value:

PV of Terminal Value =

Then, intrinsic value per share is:

下图是我的计算过程

但是是16.244,这个是不是属于计算过程中小数点省略的问题?

第二个问题是为什么不是用 Rt = Rt-1 * w,还是没理解?

考试遇到这个问题到底是用w还是不用w ?