NO.PZ2018103102000065

问题如下:

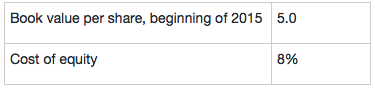

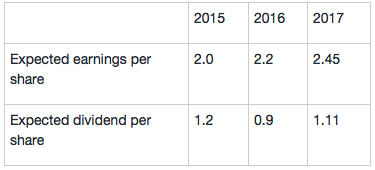

Jacques prepares to update the valuation of TMT. Assume that, at the end of 2016, share price is expected to equal book value per share. Based upon the information in the below table, use the multistage-stage residual income (RI) model to determine the intrinsic value of the equity of TMT as of the beginning of 2015. The intrinsic value per share is closest to:

选项:

A.16.91

B.11.36.

C.7.97

解释:

C is correct.

考点:RI

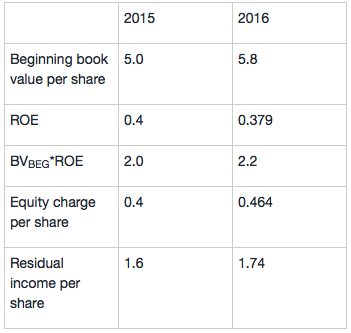

解析:C是正确的。第一步是计算2015 - 2016年的每股剩余收益:

第二步是计算终值的现值: 根据条件在2016年底,假设股价将等于每股账面价值。这就说明终值的现值等于零。

那么每股的内在价值就等于: V0=5+1.6/(1.080)+1.74/(1.08)2=7.97

如题。

这题的RI 2016的两个算法,算出来答案是不一样的。

- RI 2016 = EPS 2016 - r x B 2015,代入数字后得到 2 - 0.08x5 = 1.6

- RI 2016 = (ROE-r)x B 2015,代入数字后得到 (2.2/5.8 - 0.08)x5 = 1.496