NO.PZ201709270100000208

问题如下:

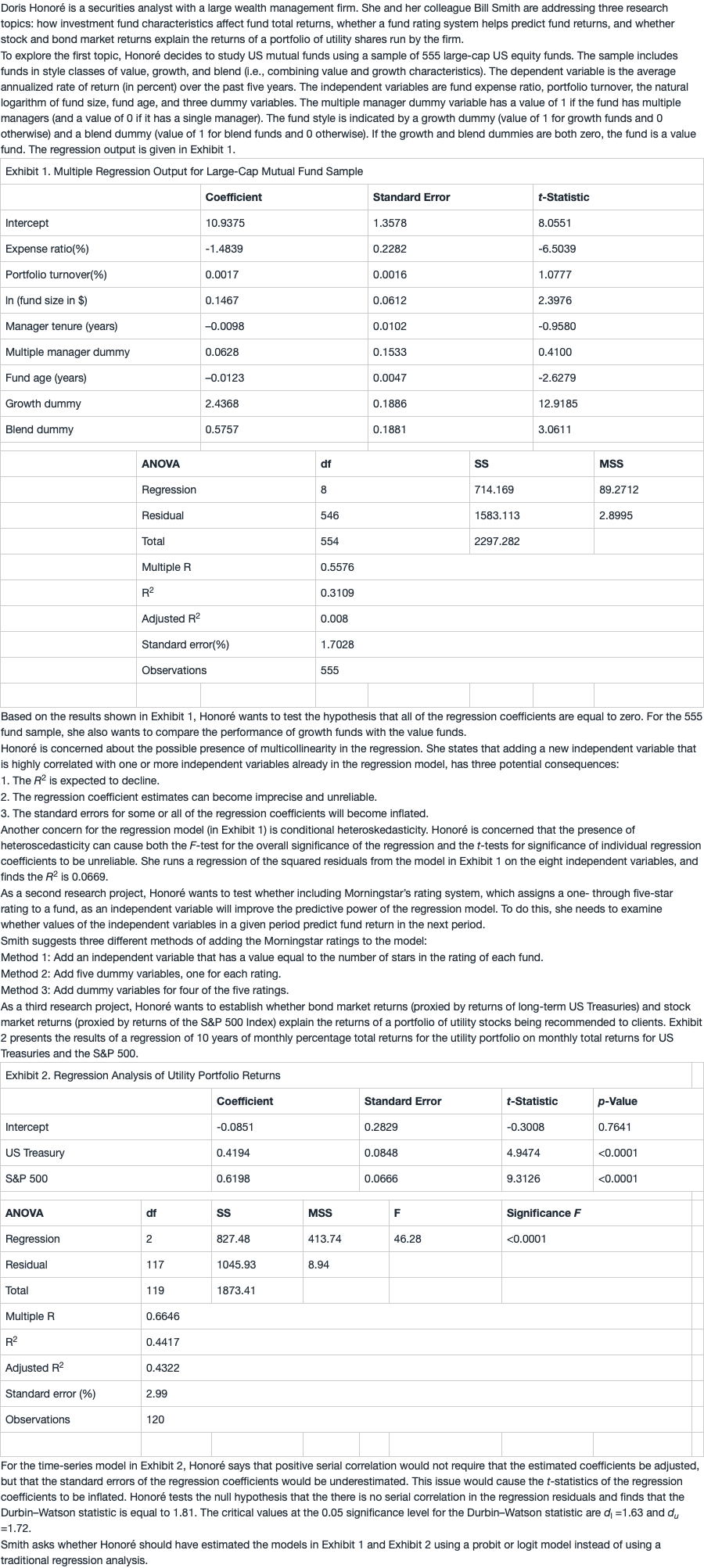

8. Should Honoré have estimated the models in Exhibit 1 and Exhibit 2 using probit or logit models instead of traditional regression analysis?

选项:

A.Both should be estimated with probit or logit models.

B.Neither should be estimated with probit or logit models.

C.Only the analysis in Exhibit 1 should be done with probit or logit models.

解释:

B is correct. Probit and logit models are used for models with qualitative dependent variables, such as models in which the dependent variable can have one of two discreet outcomes (i.e., 0 or 1). The analysis in the two exhibits are explaining security returns, which are continuous (not 0 or 1) variables.

Exhibit 2:.....establish whether bond market returns (proxied by returns of long-term US Treasuries) and stock market returns(proxied by returns of the S&P 500 Index) explain the returns of a portfolio of utility stocks being recommended to clients.

这句话的意思不是说,是否bond market returns和stock market returns可以解释什么什么吗?答案不就是要么能解释,要么不能解释吗?这个不是逻辑函数吗?