NO.PZ202208300100000405

问题如下:

The poor investment performance of the pension plan in 2017 most likely caused the periodic pension cost (in £ millions) reported in the income statement to be:

选项:

A.unaffected.

B.higher by £1,017.6.

C.higher by £751.

解释:

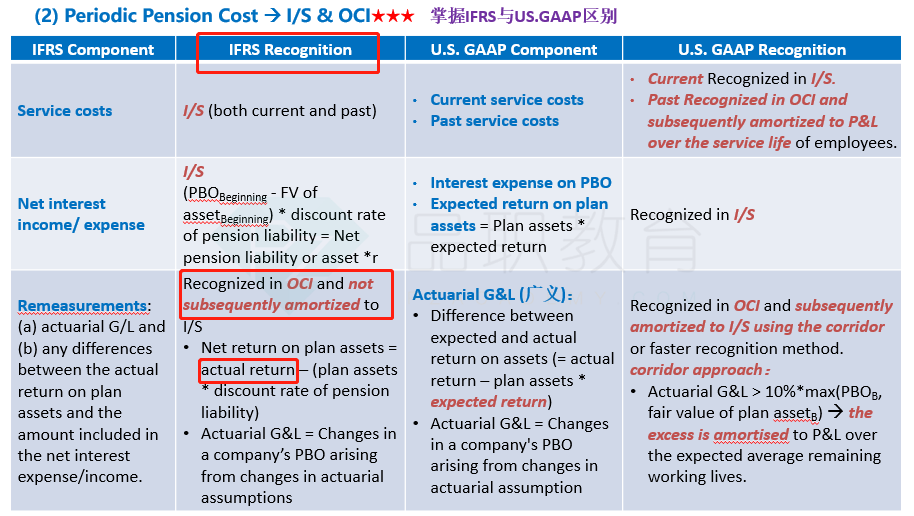

SolutionA is correct. Under IFRS, the components of periodic pension cost that are reported in P&L (income statement) are the service cost and the net interest expense or income (calculated by multiplying the net pension liability or net pension asset by the discount rate used to measure the pension liability). The actual return (negative in 2017) has no effect on the periodic pension cost reported in P&L. The actual return on plan assets will affect the net return on plan assets (part of the re-measurement component), which is recognized in OCI and not subsequently amortized to P&L.

C is incorrect. This is the amount of the actual negative ROA and assumes that amount is used in the calculation of pension expense: –18.6% × 4,038 = –751.

B is incorrect. The difference between actual and expected: (–18.6% – 6.6%) × 4,038 = –25.2% × 4,038 = 1,017.6: higher cost.

为啥选第一个,哪个知识点的?????????