NO.PZ2018113001000075

问题如下:

Matthew, a junior analyst, manages a portfolio W.

The portfolio is fully invested in US Treasuries。Matthew intends to fully hedge this bond portfolio against a rise in interest rates。

Exhibit 1 presents selected data on

Portfolio W, and the relevant Treasury futures contract, and the cheapest-to deliver

(CTD) bond.

Based on Exhibit 1, the number of

Treasury futures contracts Matthew should sell to

fully hedge Portfolio W is closest to:

选项:

A.652

B.651

C.745

解释:

B is correct

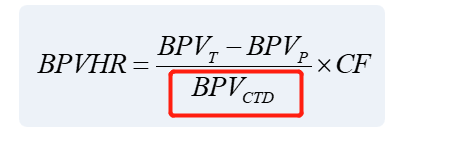

Matthew should sell 651 Treasury bond futures contracts.

中文解析:

本题考察的是利用期货合约调节组合的久期,直接带入上述公式计算即可。注意最后合约份数需要四舍五入取整数,负号代表卖出期货合约。

bond future bpv 不是应该是 1.432*100000*9*1bp吗,为什么算出Nf 跟答案不一样的。谢谢老师