NO.PZ202109080500000302

问题如下:

Moselle Wealth Advisers Case Scenario

Daniel and Marie Benetton have decided that now is the time to hire a wealth manager to help them better manage their investments as they prepare for retirement. They have gathered the following information concerning their personal financial situation:

Both Daniel and Marie are 55 years old.

Daniel is a senior IT project manager, and Marie is a nurse practitioner.

Their combined annual salary income is $260,000, and future annual pay raises are expected to keep pace with inflation.

They save 20% of their gross salary income per year.

They have two children, ages 16 and 14, who each expect to attend university for four years when they turn age 18.

Their residence is valued at $520,000, with no outstanding mortgage.

In the next 10 years, Marie expects to receive an inheritance from her mother’s estate anticipated to be worth about $1.1 million.

They currently have $2.3 million in investment and retirement portfolios, which they self-manage.

When the Benettons searched for a wealth management firm, their objective was to select a firm whose wealth managers had the following attributes:

Capital market proficiency, including sector and security expertise

Financial planning knowledge, including proficiency in insurance and taxation

Portfolio construction ability, including detailed knowledge of asset class risk, return, and correlation

After considering several wealth management firms, the Benettons hire and schedule a meeting with Peter Raphael, a private wealth manager with Moselle Wealth Advisers. Moselle specializes in serving high-net-worth individuals and families.

The meeting begins with a discussion of financial goals. The Benettons state that in the intermediate-term they plan to fund their children’s university education, which they expect will cost $350,000; would like to purchase a vacation home for no more than $425,000; and hope to retire at age 65 with an inflation-adjusted annual income of $160,000. Their long-term goals are to make a $250,000 gift to a health care charity and a $200,000 gift to Marie’s alma mater and leave an inheritance of at least $3 million in total to their children.

When Raphael asks about the retirement income goal and how the amount was determined, the Benettons respond that they hope to be able to maintain their current standard of living in retirement and stress the importance of having confidence that they will achieve their income goal for the rest of their lives.

When the conversation moves to a discussion of investment risk, the Benettons state that they are moderately conservative and have invested a large portion of their assets in securities that have below-average volatility. Raphael responds with the following comment: “As your wealth manager, I can help you better understand and shape your perception of investment risk, which would then enable you to increase your risk tolerance.”

Raphael explains that the next step is to perform a capital needs analysis to determine whether the Benettons are likely to accumulate sufficient financial resources to meet their objectives. Raphael makes the following comments comparing the two methods for evaluating capital sufficiency—the Monte Carlo and deterministic models.

Both models are based on forward-looking capital market projections, with the Monte Carlo model assuming a compound return and the deterministic model assuming linear portfolio growth.

An advantage of the Monte Carlo model is that it can be customized to include input data for such variables as inflation expectations and management fees.

Unfortunately, neither model is able to take into account the impact of taxes on investment returns.

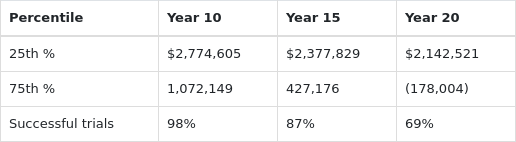

When the Benettons express an interest in learning more about the Monte Carlo model, Raphael provides the example presented in Exhibit 1. He explains that the model results are based on a hypothetical client with a conservative risk profile who has established multiple goals over a 20-year time horizon. The client has set confidence levels for meeting the goals at 95%, 85%, and 75% at 10, 15, and 20 years, respectively.

Exhibit 1:

Monte Carlo Simulation Results—Example

Question

The Bennetton’s financial goals are best described as lacking:

选项:

A.prioritization. B.stratification. C.specification.解释:

SolutionA is correct. The Benetton’s goals lack prioritization. The goals do demonstrate specification, in that they identify both the time frame and amounts. Stratification is not a characteristic of goals but is a methodology used in equity indexing.

B is incorrect. Stratification (stratified sampling) is a methodology frequently used in equity indexing when a portfolio manager wants to track indexes that have a large number of constituents or when dealing with a relatively low level of assets under management.

C is incorrect. A time frame and amount were specified for each goal.

麻烦老师讲下C选项,谢谢