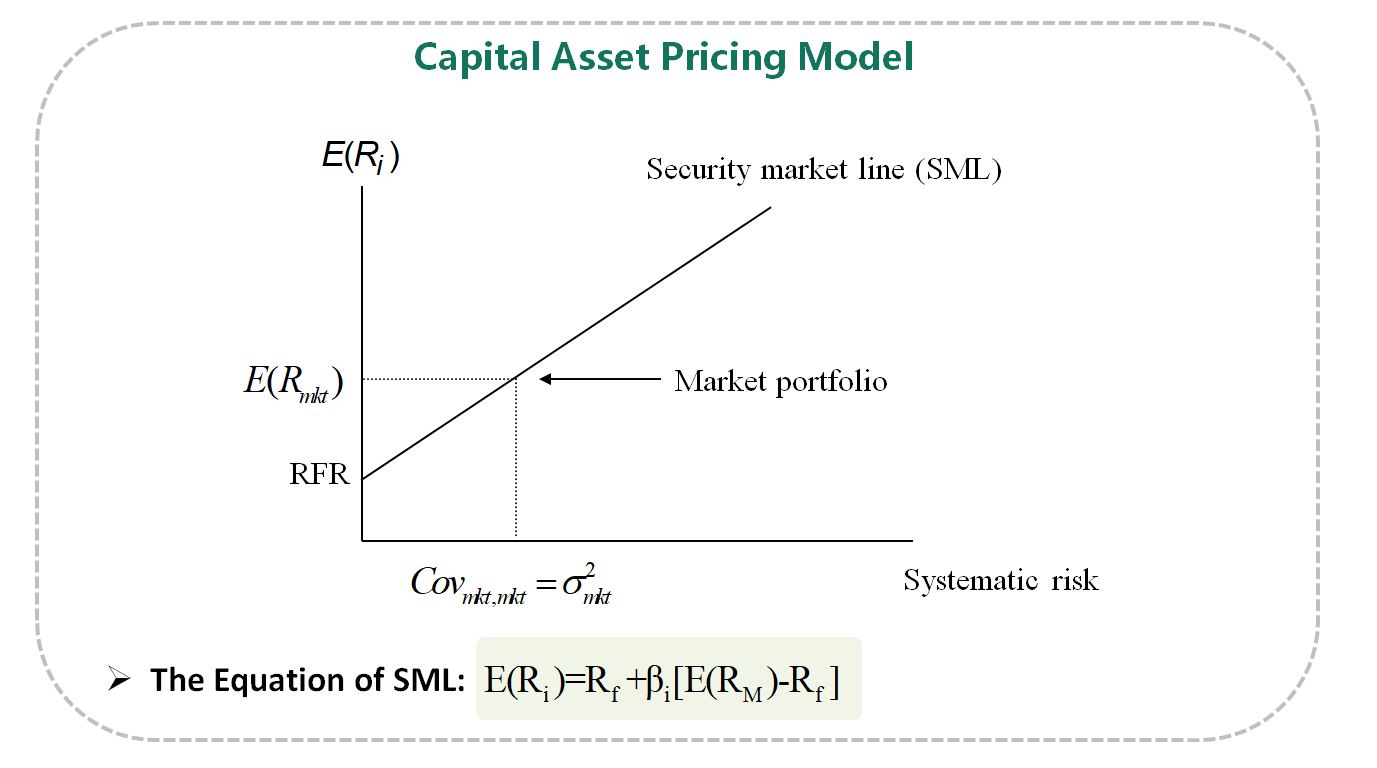

“The SML is the equation that specifies the required/expected return for a security that is implied by the CML when the market is in equilibrium.”

(Institute 268)

Institute, CFA. 2018 CFA Program Level II Volume 6 Alternative Investments and Portfolio Management. CFA Institute, 07/2017. VitalBook file.

所提供的引文是一个指南。请在使用之前查看每个引文以确保准确性。

这是portfolio management process 书后14题的节选,二级教材似乎并未涉及cml和sml线,我只记得sml线横坐标为beta,cml线为系统风险的标准差,题干中整体sml线与cml线的关系解释我没看懂,market is in equilibrium又是什么意思?二级考试还会涉及一级的知识点吗?