NO.PZ2018062016000075

问题如下:

Given the probability matrix above, what is the covariance of returns on Portfolio A and Portfolio B?

选项:

A.0.02

B.-0.0546

C.-0.16

解释:

B is correct.

E(RA)=0.4*(-10%)+0.3*10%+0.3*30%=8%

E(RB)=0.4*50%+0.3*20%+0.3*(-30%)=17%

Cov(RA,RB)=0.4*(-10%-8%)*(50%-17%)+0.3*(10%-8%)*(20%-17%)+0.3*(30%-8%)*(-30%-17%)= -0.0546

Cov(RA,RB)=0.4*(-10%-8%)*(50%-17%)+0.3*(10%-8%)*(20%-17%)+0.3*(30%-8%)*(-30%-17%)

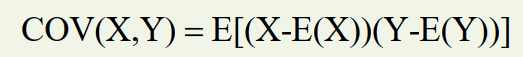

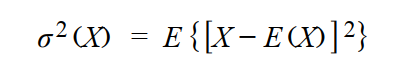

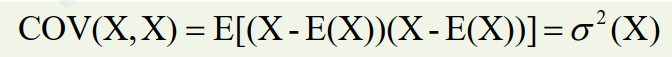

请问这个求COV我看跟求组合方差是一样的,唯一的不同只是求组合方差需要算到平均距离的平方是吗?所以求COV跟求方差的公式差不多?