NO.PZ201511190100000307

问题如下:

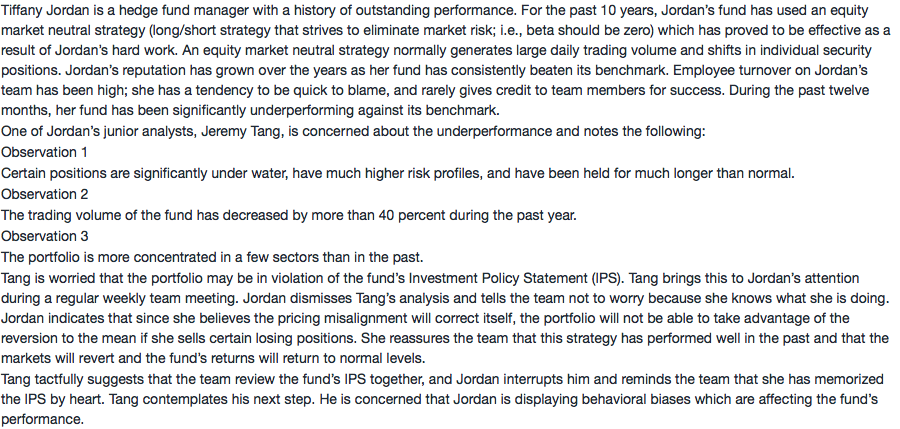

Which of Tang’s findings is not a typical consequence of self-control bias?

选项:

A.Failure to explore other portfolio opportunities.

B.Asset allocation imbalance problems in the portfolio.

C.A higher risk profile in the portfolio due to pursuit of higher returns.

解释:

A is correct.

Failing to explore other opportunities is a demonstration of status quo bias, not self-control. Self-control bias occurs when individuals deviate from their long-term goals, in this case, the investment policy statement, due to a lack of self-discipline. Jordan is not adhering to the strategy which has been successful in the past. The consequences of self-control bias include accepting too much risk in the portfolio (C) and asset allocation imbalance problems (B) as Jordan attempts to generate higher returns.

B的选项不均衡,是因为他会选择给income 的

C是缺钱所以需要更多钱追求更高收益。

老师 我不是很理解A

他不自律不就是会放弃了很多选择吗?选的就是对他短期有里的东西,而放弃了很多长期的选择。