NO.PZ201511190100000302

问题如下:

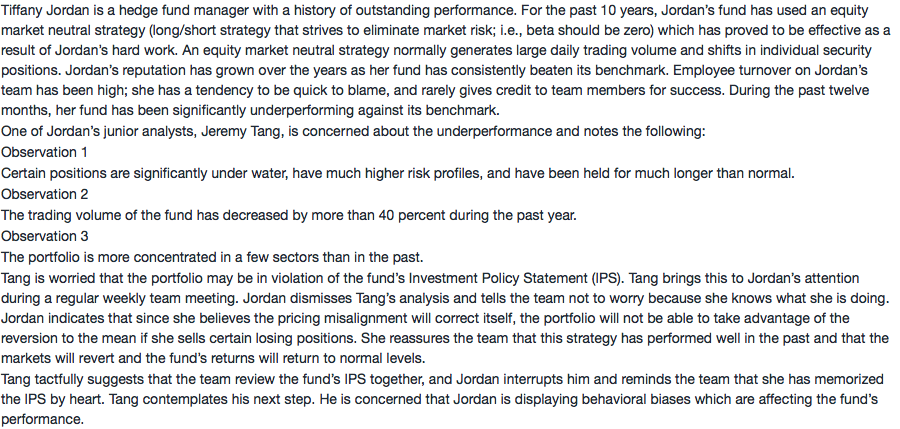

Which of Tang’s observations is least likely to be the consequence of Jordan demonstrating loss-aversion bias?

选项:

A.Observation 1.

B.Observation 2.

C.Observation 3.

解释:

C is correct.

Loss aversion by itself may cause a sector concentration; however, a market neutral strategy tends to focus on individual stocks without regard to the sector. The sector exposure would be mitigated with the balancing of the individual long and short positions.

- Observation 2: The trading volume of the fund has decreased by more than 40 percent during the past year.

- Observation 3: The portfolio is more concentrated in a few sectors than in the past.

B: 他loss aversion 就将亏损的股票全部持有,好的股票都卖了,trading volume为什么会下降啊?不是应该不变或者上升吗?

C:亏的都留着在,那就是可能集中在某些行业,因为行业风险的原因一亏都亏,所以更集中

C应该是对的的呀 B是错的呀,求解