NO.PZ2019120301000236

问题如下:

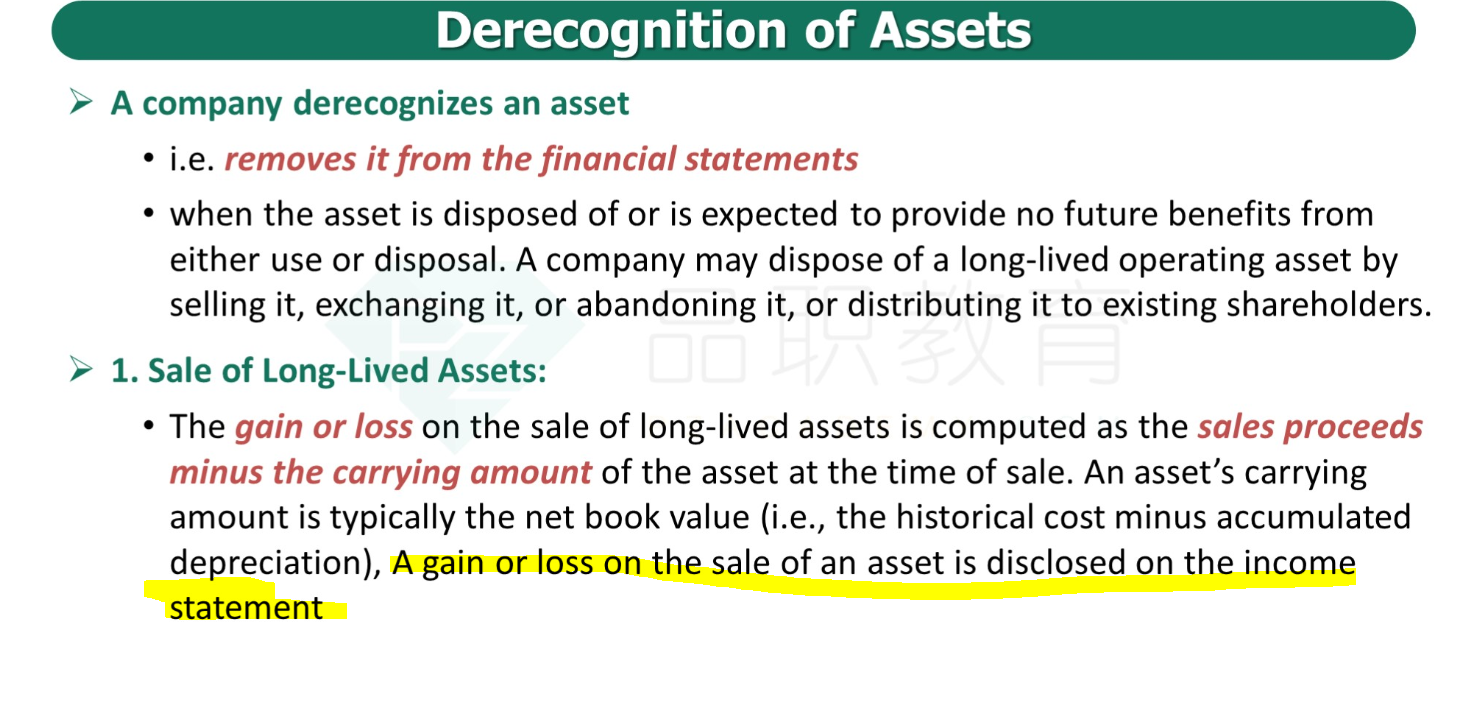

Question A company is selling a long-lived asset with a carrying amount of $70,000 for $80,000. The original cost of this asset was $120,000. In the year of sale, this event is most likely to be reported on the income statement as:选项:

A.a gain of $10,000. B.a loss of $40,000. C.revenues of $80,000.解释:

SolutionA is correct. When a long-lived asset is sold, only the net gain or loss is reported on the income statement. The gain or loss on a sale = Sales proceeds – Carrying amount = $80,000 – $70,000 = $10,000 gain.

B is incorrect. It incorrectly subtracts original cost from sales proceeds: $80,000 – $120,000 = a loss of $40,000

C is incorrect. For the sale of capital assets only the net gain or loss is reported not the gross proceeds.

老师请问这题是因为没有说明在revaluation model的情况下,所以gain也可以记入I/S中嘛?