NO.PZ202208160100000303

问题如下:

Daltonia Case Scenario

Daltonia is a medium sized developing country. Government policies have gradually opened the borders for international trade and the flow of capital. Trade is now substantial with members of the EU and is often denominated in Euros (€). During the early 2000s, privatization of some publicly owned industries, creation of a new free-floating currency, the Dornan (DRN), and sound policies implemented at the central bank put the economy on a track for steady growth and stability. Foreign currency reserves are sizable in comparison to the average daily turnover of the DRN.

Naim Birol, Minister of Finance for Daltonia, is preparing his annual report on the state of the economy and currency markets for the legislative branch of government. He will examine the long- and short-term trends in GDP growth, per capita income, inflation, and exchange rates. He is also responsible for recommending policy initiatives for the legislature to consider in order to promote overall economic prosperity for Daltonian citizens.

In order to estimate long-term GDP growth, Birol examines the data in Exhibit 1 intending to use Solow’s growth accounting equation.

Exhibit 1

Long-Term Trends of Daltonian Economy

Birol consults his colleague Ziya Pamuk to review the policy choices facing the Daltonian government and the possible effects on economic growth and per capita income.

Pamuk states:

“Daltonia’s politicians are debating the effects of growth rate policies focused on three outcomes:

-

higher rates of saving and investment

-

importing more technological innovations

-

greater investment in research and development (R&D)

I conclude that the impact from these policies will cause a long-term increase in the economy’s growth rate and our standard of living. Furthermore, if we emphasize R&D spending, then higher rates of saving and investment are unlikely to encounter diminishing marginal returns.”

Birol believes Daltonia needs to address a recent increase in inflation and appreciation in the exchange rate. Should these trends accelerate, the country’s present prosperity could be threatened. Birol and Pamuk discuss policy alternatives.

-

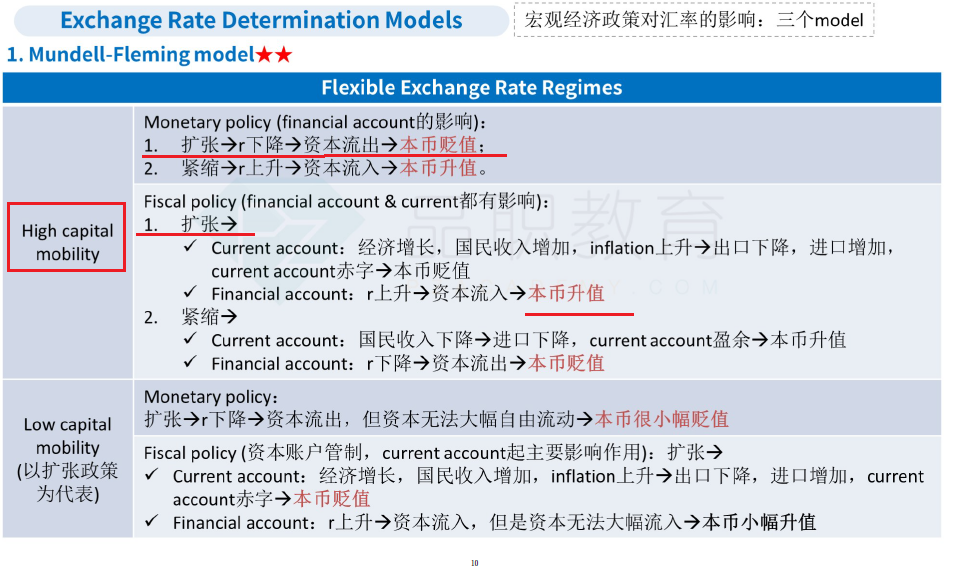

Birol states: “Since Daltonia allows capital to flow freely, the clearest choice is to implement expansionary monetary and fiscal policies to stop the appreciation of the currency according to the Mundell–Fleming model.”

-

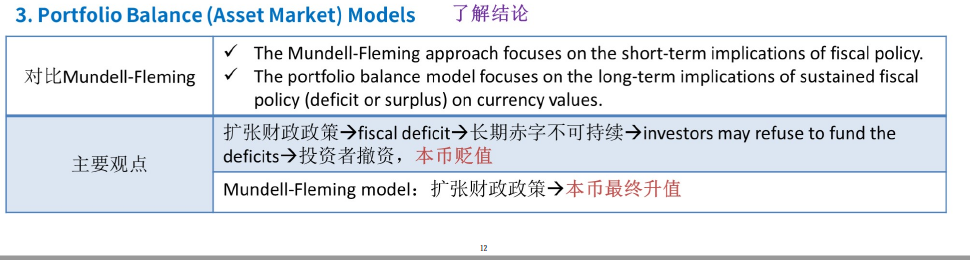

Pamuk replies: “The long run solution to the problem, at least according to the portfolio balance approach, would be a policy choice by the Daltonian government to run large budget deficits on a sustained basis.”

-

Birol adds: “There is also a timing dimension to consider. According to Dornbusch, with inflexible domestic prices in the short run, any decrease in nominal money supply will induce an increase in the domestic interest rate. This will encourage capital inflows and cause the exchange rate to overshoot to the upside in the short run, until domestic prices have a chance to react.”

Birol wants to be on the lookout for situations which might trigger a currency crisis. He and Pamuk discuss recent economic developments that might provide potential warning signs.

-

Birol: “Moving our currency to a floating exchange rate has reduced our susceptibility to a currency crisis.”

-

Pamuk: “Banking crises often precede currency crises, but our banking sector has grown and strengthened substantially by offering foreign denominated savings accounts to foreign investors and lending those funds for domestic infrastructure investments.”

-

Pamuk: “I’m concerned that the ratio of exports to imports has been increasing recently and the ratio of M2 to bank reserves has been falling.”

In examining the currency markets, Birol is concerned that local currency dealers are being taken advantage of by arbitrageurs from Europe. He analyzes the rate quotes in Exhibit 2 for evidence of triangular arbitrage and carry trade opportunities by European hedge funds attempting to exploit the DNR currency.

Exhibit 2

Interbank and Dealer Currency Quotes and Rates

Which of the statements regarding policy alternatives discussed between Birol and Pamuk in response to Daltonia’s recent increase in inflation and deterioration in exchange rate is least accurate?

选项:

A.Birol’s statement regarding Dornbusch B.Pamuk’s statement regarding the portfolio balance approach C.Birol’s statement regarding Mundell–Fleming解释:

SolutionC is correct. Birol’s statement regarding the Mundell–Fleming model is inaccurate because restrictive (not expansionary) fiscal policy, along with expansionary monetary policy, would lead to capital outflows and cause the currency to depreciate assuming high capital mobility.

A is incorrect because Birol’s statement regarding Dornbusch is accurate.

B is incorrect because Pamuk’s reply regarding the portfolio balance approach is accurate.

看了解析,也看了视频,但还是很糊涂,能否把这是三个statement都讲讲?