NO.PZ202208300100000505

问题如下:

Mark Crawley Case Scenario

Mark Crawley is an analyst at a London-based private equity firm and is reviewing the firm’s file on Thames Air Plc (Thames), a company it provides financing for. Thames uses International Financial Reporting Standards (IFRS) in the preparation of its financial statements. Thames is a relatively new airline based in the United Kingdom specializing in flights and vacation packages to Mediterranean locations, primarily Spain. Thames sells most of its flights and vacation packages to British residents in British pounds (GBP) and considers the costs of local competitors’ packages when determining its prices. Costs are incurred in multiple currencies:

Wage costs are primarily in GBP.

Typical of the industry, airline fuel and lease costs are normally priced in US dollars (USD).

The landing fees paid at the vacation-area airports are in the local currency, primarily euros (EUR).

First, Crawley turns his attention to the effect of the transactions undertaken in various currencies by Thames.

He reviews the change in the exchange rate for the USD to GBP during 2015, shown in Exhibit 1, and wonders what the effect of this change was on Thames’s operating income.

At year-end (31 December), Thames had a large outstanding payable in Spain related to landing fees that were incurred there evenly over the final quarter. The company paid the amount in full on its due date of 28 February. Crawley observed that the EUR to GBP exchange rate had changed between when the costs were incurred and the year-end and again by the payment date, as also shown in Exhibit 1.

Exhibit 1

Selected Exchange Rate Data

Because of the growing demand for vacation rentals in Spain during the past year, Thames acquired 100% of Tagus SA (Tagus), a Spanish company that owns a small vacation hotel and a few villas. Tagus has long-term debt outstanding from a Spanish bank that financed the 2012 purchase of the vacation properties, which will now be rented as part of the vacation packages offered by Thames. Tagus incurs all costs related to operating and maintaining the rental properties in EUR.

Since the acquisition, all of Tagus’s revenue comes from Thames’s sales in Britain of the vacation packages. Tagus receives the amounts in GBP. But Tagus hopes to expand and start renting out any excess capacity of the properties, or newly acquired properties, to local tourists in the next few years. Crawley notices that Thames is using the temporal method to translate Tagus’s financial statements prior to consolidation and asks another analyst, Dee Chopra, if this is appropriate.

Crawley next reviews the information in Exhibit 2 related to the Tagus acquisition to consider the effect on Thames’s year-end financial statements (31 December 2015).

Exhibit 2

Selected Financial Information of Tagus SA at Acquisition and Year-End (EUR thousands)

As the final step in his review, Crawley starts a ratio analysis of Thames and Tagus, and he asks Chopra which ratios, if any, would be unaffected by Thames’s choice of translation method for Tagus.

Question

The most likely effect of the change in the exchange rate between the EUR and GBP arising from Thames’s investment in Tagus in 2015 will be a translation:

选项:

A.loss reported in net income. B.adjustment reported in other comprehensive income. C.gain reported in net income.解释:

Solution

A is correct. Thames is using the temporal method for its translation of Tagus, and the initial exposure is a net liability exposure (monetary liabilities of EUR13,500 exceed the monetary assets of EUR4,000). The EUR strengthened against the GBP during the six-month period (from GBP0.7200/EUR to GBP0.7500/EUR). The net effect of having a net liability position in a strengthening currency will be a translation loss for Thames, which, under the temporal method, is reported in net income.

B is incorrect. Under the temporal method, it is reported in net income not other comprehensive income.

C is incorrect. Due to the net liability position in a strengthening currency, it will be a loss not a gain.

中文解析:这道题考查的是报表转换的风险敞口。

题干给了Tagus公司的报表,以及欧元和英镑的汇率变化。

接下来题目问,欧元和英镑的汇率变化会导致母公司转换子公司报表时产生的汇率转换是损失还是收益。

在时态法下,只有货币性资产和负债才使用当前汇率进行转换,一般情况下,货币性负债大于货币性资产,那么对于公司来说风险敞口就等于货币性资产和货币性负债的差,即转换风险敞口=货币性资产-货币性负债<0

通常,时态法下的转换风险敞口为净负债敞口(net liability balance sheet exposure),当外币(当地货币)升值时,转换后的净负债更多,对公司来说是转换损失(translation loss)。反之会带来转换收益(translation gain)。

A选项正确。母公司使用时态法转换子公司报表。子公司的货币负债=current liability+long term debt=13500欧元;货币资产= cash and accounts receivable =4000欧元,货币负债超过货币资产,所以初始风险敞口是净负债风险敞口。在6个月的时间里汇率从0.7200GBP/EUR到0.7500GBP/EUR,欧元走强,所以净负债是增加,母公司是汇率转换损失,根据时态法,它将在净收入中报告。

B选项错误,在时态法下,它被报告为净收入,而不是其他综合收入。

C选项错误,由于走强货币的净负债头寸,这将是一种损失,而不是一种收益。

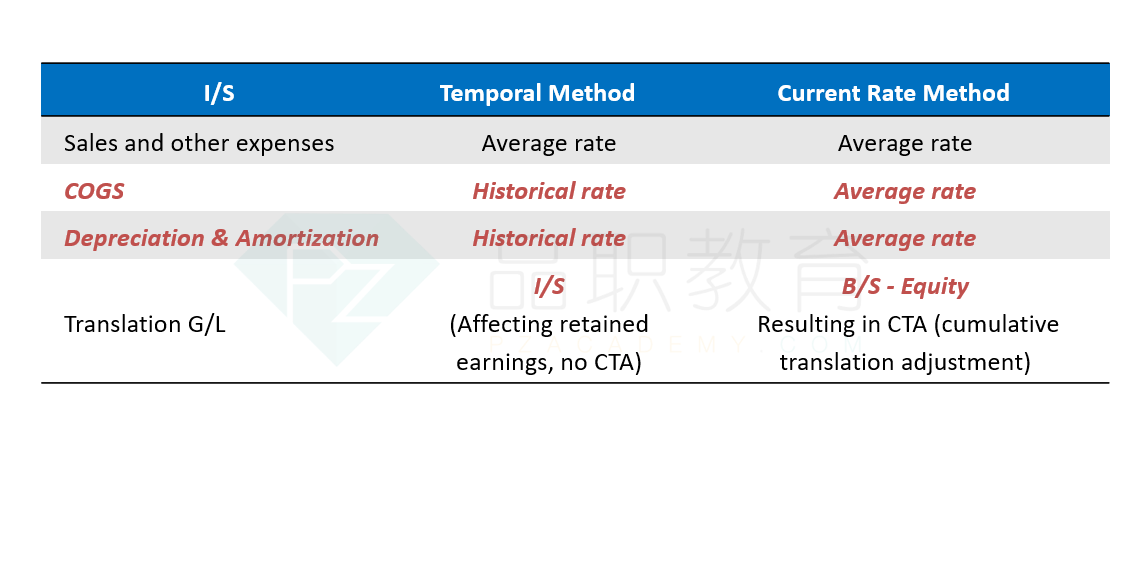

虽然我做对了,我知道是loss,但是有点不明白,是直接记在net income吗?不是OCI吗?