NO.PZ2018062004000165

问题如下:

Company M follows IFRS and uses the revaluation model to record its long-lived assets. It cost $100,000 of the company to purchase an equipment in 2014, unexpectedly, in 2015 the equipment has a fair value of $102,000. Is it appropriate for company M to show a profit in its financial statement?

选项:

A.It is inappropriate, the increased fair value should never be regarded as a profit.

B.It is inappropriate, the revaluation should be recorded in equity.

C.It is appropriate.

解释:

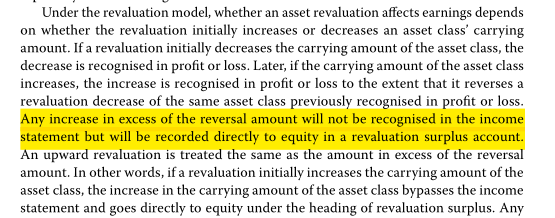

B is correct. The increased fair value can be regarded as profit based on IFRS, but only when the identical asset has been recognized in the income statement previously. In the given condition, the revaluation should be recorded in equity directly.

老师能否解释一下B选项