NO.PZ2018070201000110

问题如下:

Based on capital market theory, as all investors has the homogeneity assumption with same economic expectation of future cash flow for all assets, all the investors is most likely to invest in:

选项:

A.All investors will invest in the same optimal risky portfolio.

B.All investors will invest in the Standard and Poor’s 500 Index.

C.All investors will invest in assets with the same amount of risk.

解释:

A is correct.

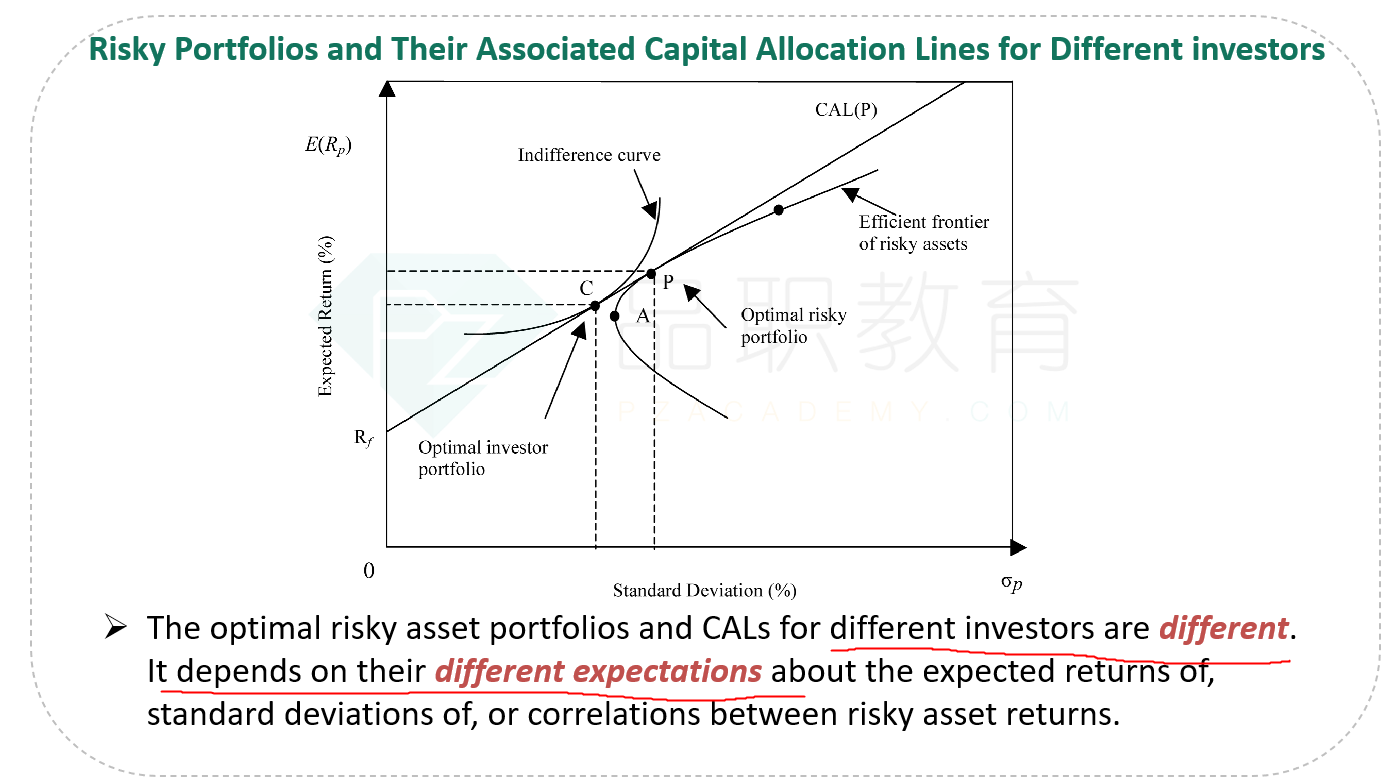

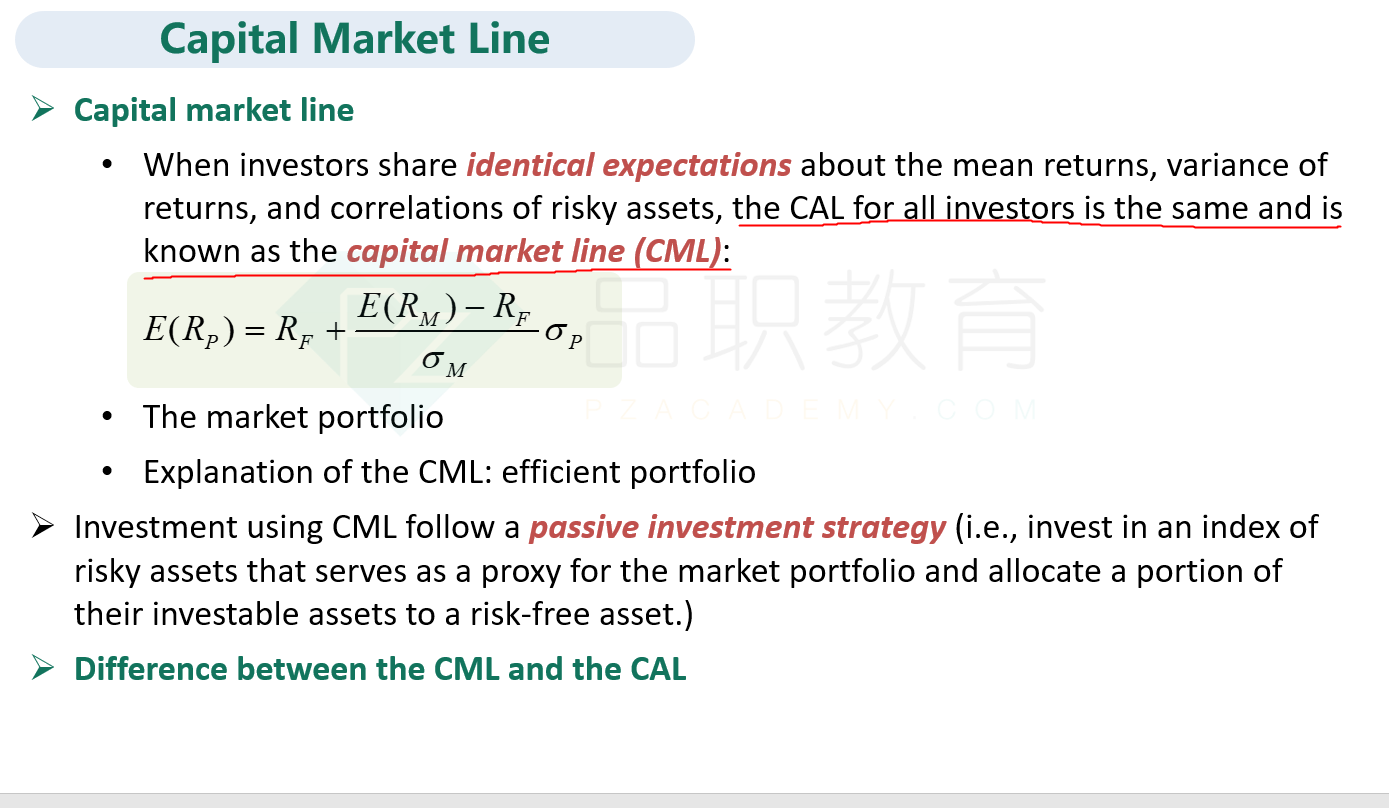

According to the homogeneity assumption, all investors have the same economic expectation of future cash flows and would therefore invest in the same optimal risky portfolio, implying the existence of only one optimal portfolio (which is the market portfolio). .

没明白这个解释:https://class.pzacademy.com/qa/60403