NO.PZ202208300100000305

问题如下:

Atlantic Preserves Case ScenarioJim Loris is the Food and Beverage analyst at Eastern Trust & Investments. Jeremy Paul is an intern under Loris’s supervision. Loris is planning on reviewing the financial statements of Atlantic Preserves, Inc., in the next few days. The company has recently signed a new collective agreement with its workers, and Loris is interested in seeing how the company’s employment costs have been affected. The company prepares its financial statements in accordance with US GAAP, and the new collective agreement became effective 1 January 2018.

Paul extracts portions of the new collective agreement related to the pension plan and mentions to Loris that there have been two changes related to the plan:

The benefit formula has been changed to 1.75% × Final year’s salary × Number of years of service under the plan. Previously, the same formula was used, but with a factor of 1.65%.

The vesting period has been changed from four years to three years.

Paul makes the following two comments about these changes to the pension plan:

The new formula will have a big impact on income because the past service costs that arise will be expensed immediately.

The change to a shorter vesting period will give rise to an actuarial gain.

Loris responds: “The past service costs that arise will be reported in other comprehensive income and amortized on the profit and loss statement over the average service lives of the employees.”

Loris provides Paul with the information in Exhibit 1 about John Smith, an employee who has just started working for Atlantic, and other information taken from the company’s pension plan disclosures. Loris asks Paul to calculate the pension liability arising from Smith.

Exhibit 1

Assumptions Relating to the Liability Arising from John Smith’s Pension

Following his calculation of the pension plan liability, Paul asks Loris two questions about the discount rate that is used:

Exhibit 1 does not mention how you determined the discount rate that was used. What rate is the most appropriate rate to use?

What would be the effect of using a higher discount rate on various components of the company’s pension plan obligation?

Loris answers Paul’s questions and then provides him with selected information from Note F of the 2017 Annual Report of Atlantic Preserves, shown in Exhibit 2. He mentions to Paul that he is aware that the company’s actual return on pension plan assets exceeds its expected return, and asks him to use the information in Exhibit 2 to calculate the periodic pension cost included in Atlantic’s 2017 income statment.

Exhibit 2

Selected Information from Note F of Atlantic’s 2017 Annual Financial Statements ($ thousands)

Finally, Loris tells Paul that he intends to adjust Atlantic’s operating income so that it excludes the non-operating components of the reported pension expense. Paul asks what portion of Atlantic’s reported pension expense should be considered as an operating expense.

选项:

A.1,995.00 B.976 C.2,267.00解释:

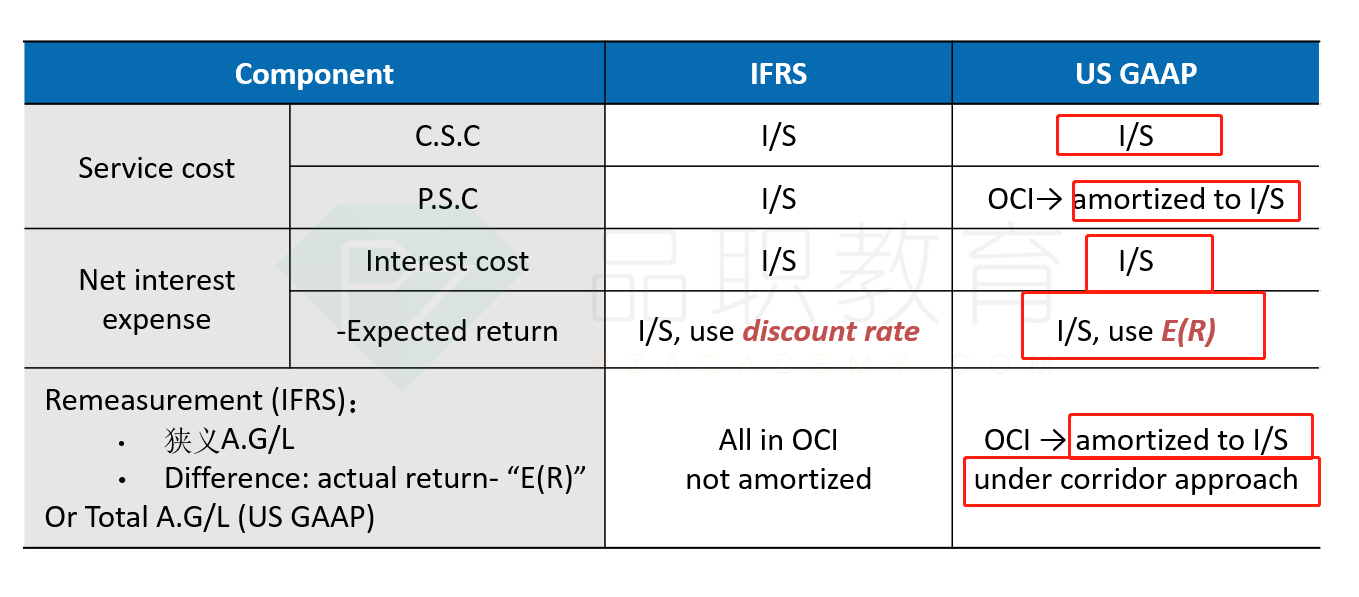

SolutionC is correct. Under US GAAP, the periodic pension cost is calculated as follows:

A is incorrect. It ignores the amortization of past service costs: 1,151 + 5,441 – 4,597 = 1,995 (or 2,267 – 272).

B is incorrect. It deducts actual ROA not expected: 1,151 + 5,441 – 5,888 + 272 = 976.

做错了好几次