NO.PZ2020021204000039

问题如下:

Approximately how many three-month Eurodollar futures contracts are necessary to hedge the six-month interest that will be paid on a USD 20 million bond? Assume that the six-month period starts at the maturity of the futures contract that will be used. (Ignore the differences between Eurodollar futures and FRAs mentioned in the chapter for this question.)

选项:

解释:

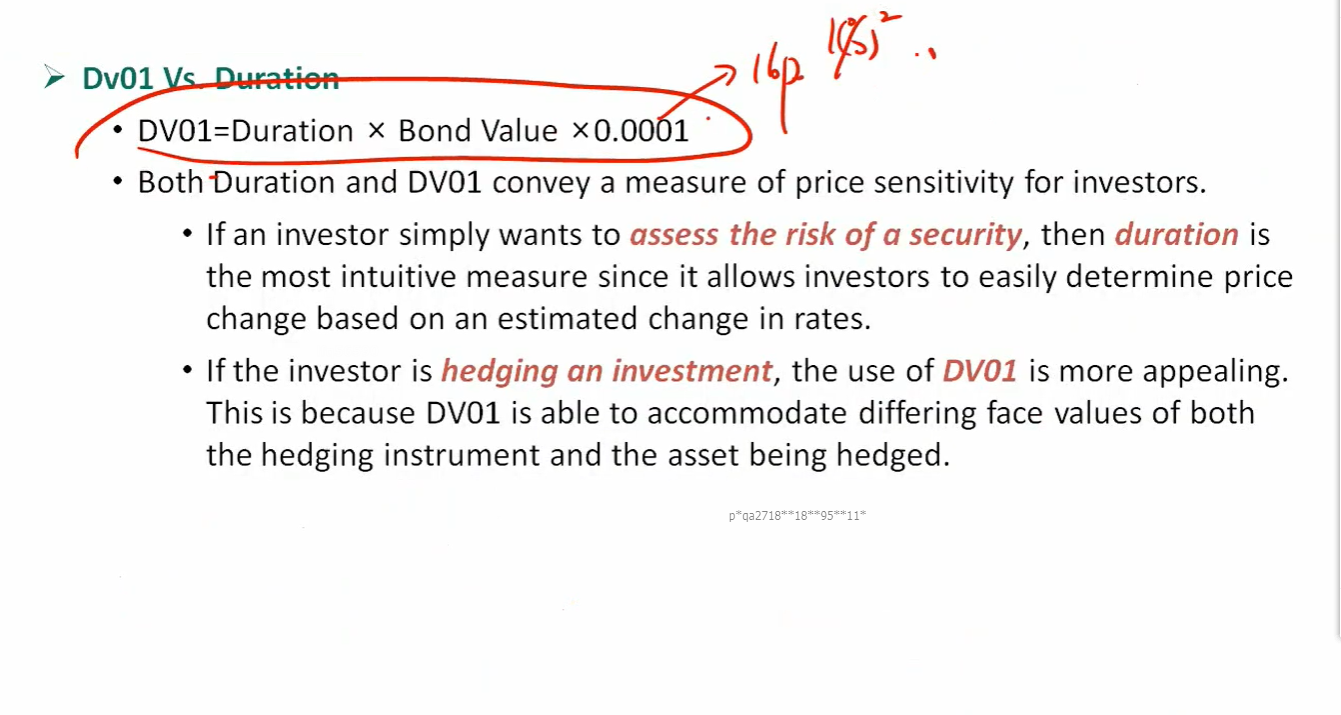

The change in the value of the instrument for a 1-basis point parallel shift in the interest rate is

USD 20,000,000 x 0.5 x 0.0001 = USD 1,000

This is 40 times USD 25. It follows that 40 contracts should be shorted.