NO.PZ201602060100001402

问题如下:

Given Ruiz’s belief about the direction of exchange rates, Eurexim’s gross profit margin would be highest if it accounts for the Ukraine subsidiary’s inventory using:

选项:

A.FIFO and the temporal method.

B.FIFO and the current rate method.

C.weighted-average cost and the temporal method.

解释:

B is correct.

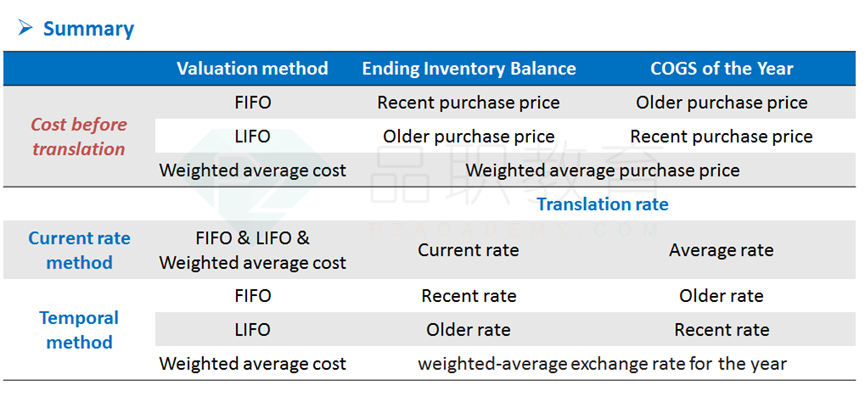

Ruiz expects the EUR to appreciate against the UAH and expects some inflation in the Ukraine. In an inflationary environment, FIFO will generate a higher gross profit than weighted-average cost. For either inventory choice, the current rate method will give higher gross profit to the parent company if the subsidiary’s currency is depreciating. Thus, using FIFO and translating using the current rate method will generate a higher gross profit for the parent company, Eurexim SA, than any other combination of choices.

考点:temporal/current method

解析:

Gross profit margin=(sales-COGS)/sales

FIFO LIFO不影响sales,两种转换方法下sales都用average rate转换,没有区别,因此选转换后gross profit margin最高的,就是选转换后COGS最低的。

A选项 FIFO + temporal:COGS转换前代表的是较早采购的存货的价值(低),temporal method用的historical rate也是卖掉的存货采购时候的历史汇率,在FIFO的情况下,也就是较高的历史汇率。(UAH贬值)

B选项 FIFO + current:COGS转换前代表的是较早采购的存货的价值(低),current rate method用的是average rate,相比A选项,是更接近现在的汇率,因此是更低的历史汇率。

选项AB相比较,转换前的COGS相同,转换汇率B选项更低,因此B选项转换后COGS更低,选项A排除。

C选项 weighted average cost + temporal:转换前COGS代表的是平均存货的采购价格,转换汇率用的是卖掉的存货采购时汇率的平均值,我们可以简单理解为就是average rate,所以C选项是average的存货成本,用average的汇率转换。

选项BC的转换汇率相同,都是average的,但是B转换前的COGS更小,因此B选项转换后的COGS更低,排除C。

正确答案为B。

为什么B选项转换前的COGS更小,B选项转换后的COGS更低呢?