NO.PZ2019070901000096

问题如下:

The Basel market risk capital calculation has changed from Basel I, Basel II.5 to the Fundamental Review of the Trading Book (FRTB). Which of the following correctly describe the change?

选项:

A.According to FRTB, the expected shortfall should be calculated with a 99% confidence interval.

B.Under this FRTB proposal, banks would be required to combine a 10-day, 99% VaR with a 250-day stressed VaR

C.A 99% value a risk(VaR) is used as a measure for market risk in the Basel I and Basel II.5.

D.The stressed VaR was first added in Basel II.5, which measures the behavior of market variables during a 10-day period of stressed market conditions.

解释:

C is correct.

考点:Basel I, Basel II.5和FRTB中的市场风险

解析:

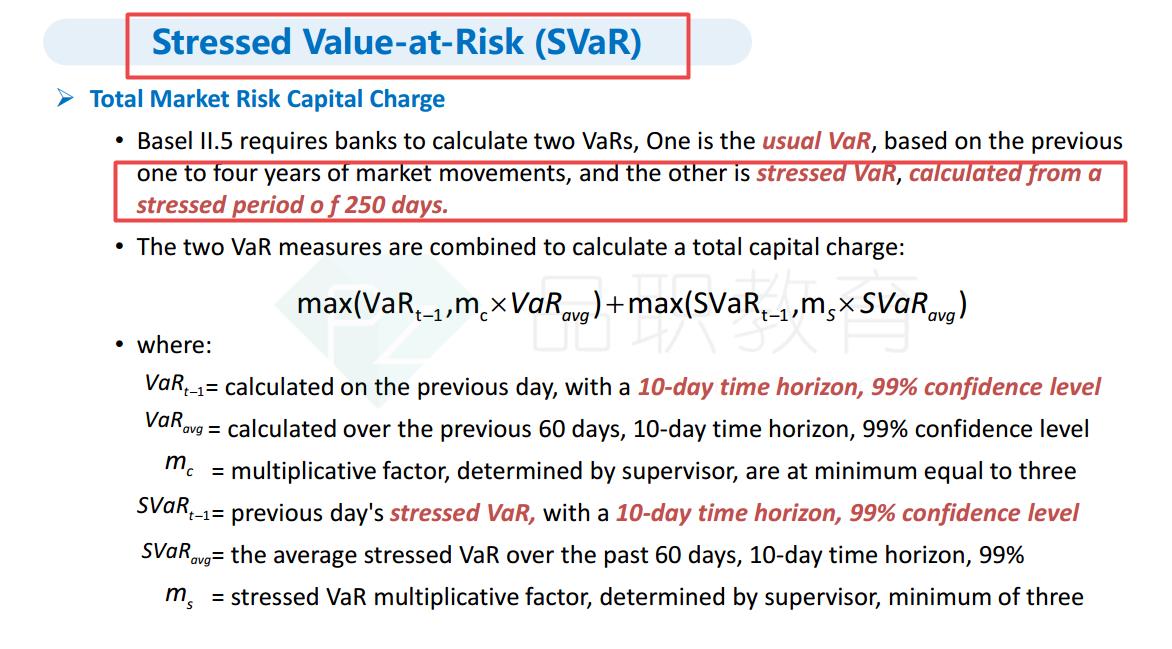

Basel I和Basel II.5中的VaR都是99%的置信度,选项C正确。

FRTB中的expected shortfall的置信度为97.5%,选项A错误。

根据FRTB,银行仅仅应该计算expected shortfall,选项B错误。

Basel II.5中增加了stressed VaR,但应该在250天的市场极端情况下计算,因此D选项错误。

老师basel 2.5 应该考虑过去60天的stress var吧?