NO.PZ202208300100000201

问题如下:

The most appropriate value (in millions) for Suburban’s investment in West Reach at December 31, 2016, is:选项:

A.$12.00. B.$13.68. C.$14.88.解释:

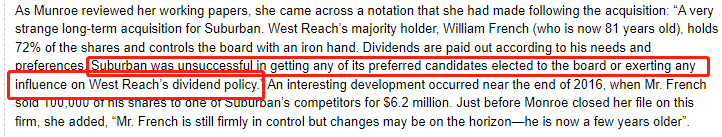

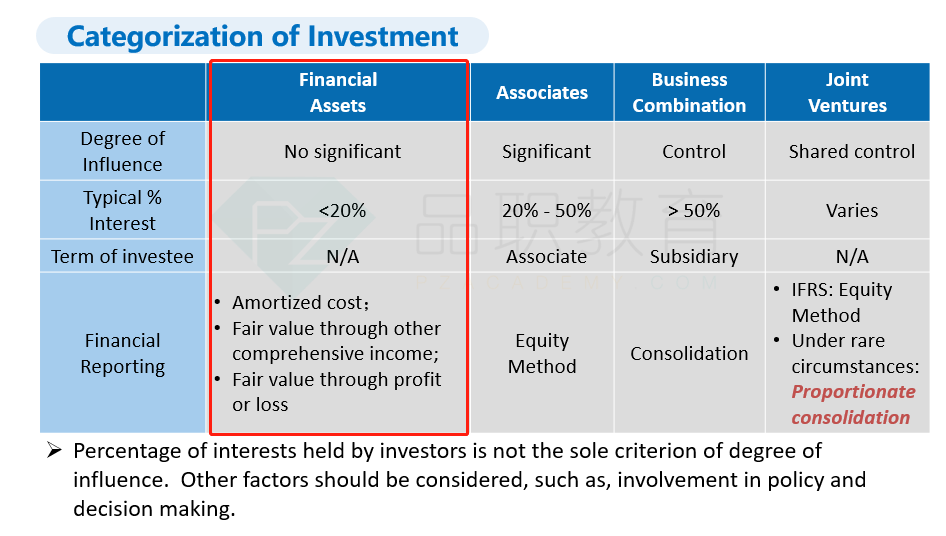

SolutionC is correct. Although Suburban’s ownership interest (24%) in West Reach exceeds the amount that is normally deemed sufficient to presume significant influence (20%), the inability to elect directors or influence the firm’s policy making indicates a lack of significant influence. It would thus be inappropriate to account for its holdings under the equity method. Instead West Reach should be considered a passive investment of Suburban and carried at full value. Although difficult to value because of its private status, the recent sale by Mr. French provides an observable price that can be used to revalue Suburban’s holdings per the table below.

A is incorrect. This is the cost value of the investment.

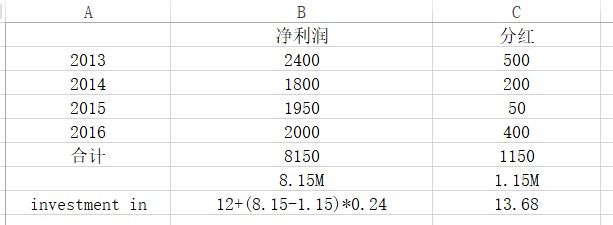

B is incorrect. This would be the value if West Reach was considered an equity investment, per the following table:

这种算法不对吗?