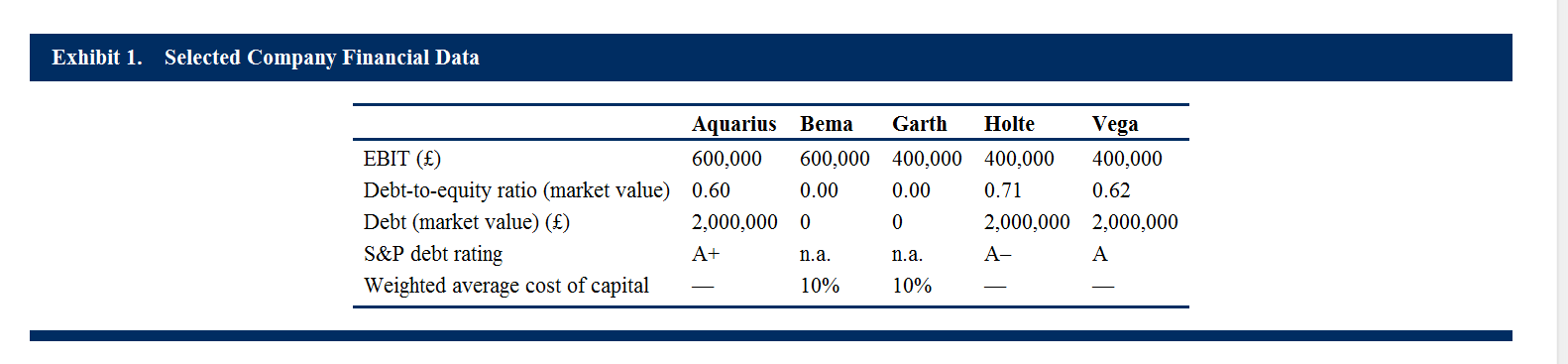

Garth has announced that it plans to abandon the prior policy of all-equity financing by the issuance of £1 million in debt in order to buy back an equivalent amount of equity. Garth’s before-tax cost of debt is 6%.

(Institute 120)

Institute, CFA. 2018 CFA Program Level II Volume 3 Corporate Finance. CFA Institute, 07/2017. VitalBook file.

所提供的引文是一个指南。请在使用之前查看每个引文以确保准确性。

Based on the MM propositions with corporate taxes, Garth’s cost of equity after the debt issuance is closest to:

10.00%.

10.85%.

11.33%.

(Institute 121)

Institute, CFA. 2018 CFA Program Level II Volume 3 Corporate Finance. CFA Institute, 07/2017. VitalBook file.

所提供的引文是一个指南。请在使用之前查看每个引文以确保准确性。

此题原来Garth公司没有债务,我想用ebit(1-t)/WACC,算出股权价值为280万,以此后续计算D/E D为100万,E回购后为180万,再根据公司计算Re为什么结果不正确?