NO.PZ2020033002000076

问题如下:

A synthetic CDO comprises two tranches, a 50% junior tranche priced at a spread J, and a 50% senior tranche priced at spread S. If the default correlations between the individual reference credit names decreased, how would spread J and spread S change accordingly?

选项:

A.Both spreads remain the same.

B.S increases relative to J.

C.J increases relative to S.

D.The effect cannot be determined given the data supplied.

解释:

C is correct.

考点:CDO

解析:

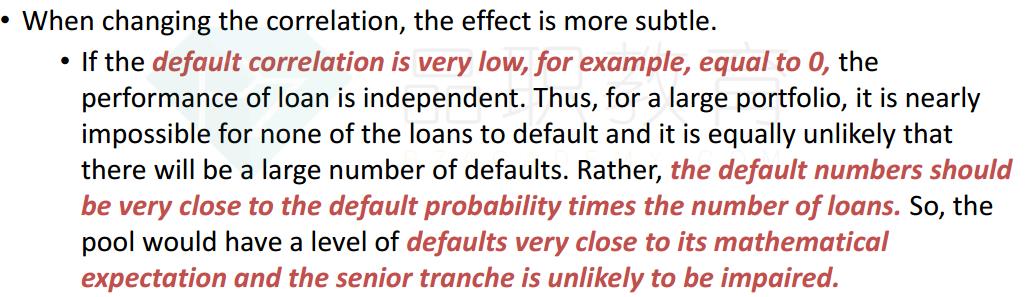

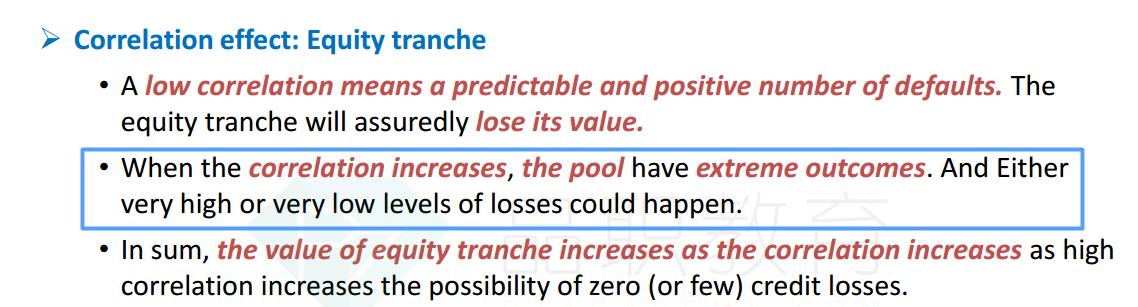

相关性降低,senior层会变得安全,它的spread会降低;junior承担损失的可能性变大,所以value会变小,junior spread变大。

相关性降低,senior层会变得安全,它的spread会降低;junior承担损失的可能性变大,所以value会变小,junior spread变大。

我的理解是,组合内成分债券的相关性降低,组合的违约概率降低,所以风险补偿应该减少,YTM减少,Credit spreads对于senior tranche 和junior tranche 都减少,但是junior tranche的减少程度大于senior tranche,所以是S靠近J

这样理解有啥不对啊?而且老师的解释我也不太看得懂,为什么相关性降低junior承担损失的可能性变大,麻烦了,谢谢!