NO.PZ2018062012000010

问题如下:

Which of the tranches of a collateralized mortgage obligation (CMO) will have the lowest prepayment risk?

选项:

A.A PAC tranches

B.An inverse floating-rate tranche

C.A support tranche

解释:

A is correct.

PAC tranches have protection against both extension risk and contraction risk, providing two-sided prepayment protection.

Support tranches expose investors to the highest level of prepayment risk and its promised interest rate is higher than the PAC tranche.

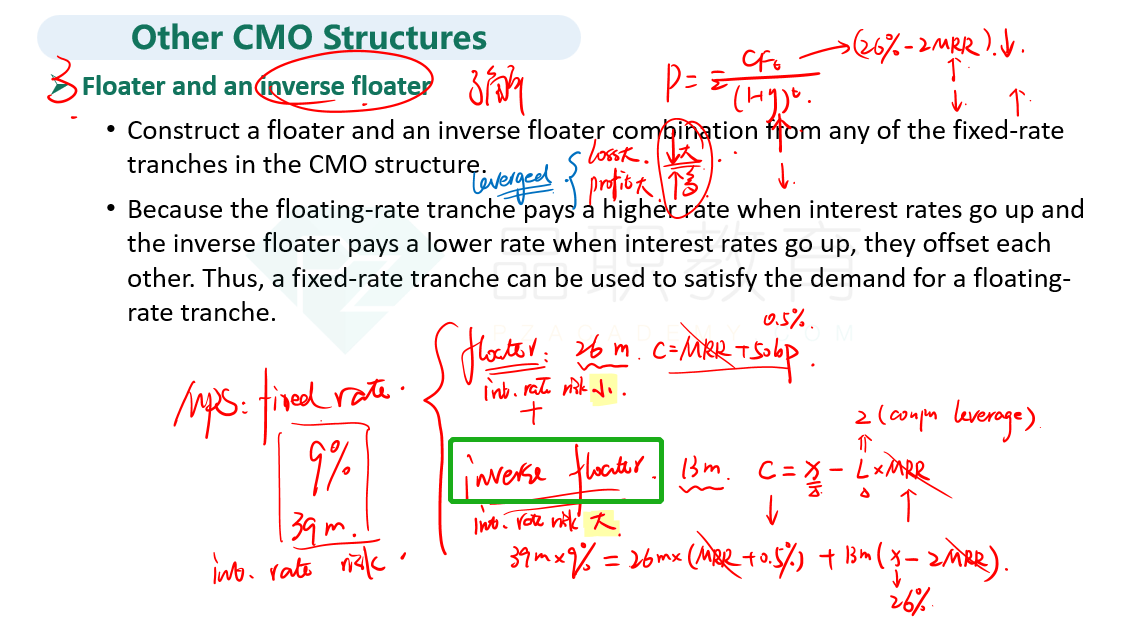

Because the inverse floater pays a lower rate when interest rates go up, thus amplifying interest rate risk.

考点:CMO

解析:当本金偿还快于预期,support tranches会吸收掉所有超过预期的偿还部分。当本金偿还慢于预期,support tranches不接受任何本金偿还,全部让给PAC结构。PAC受到了有限的保护,抵御 extension risk 和 contraction risk,这种保护来自于support结构。相反,support tranche的两种风险是最大的。故A正确。

RT