NO.PZ202206210100000204

问题如下:

In Remington and Montgomery’s discussion with Winfield on resampling, Montgomery’s comment is most likely:选项:

A.correct. B.incorrect regarding estimation errors. C.incorrect regarding diversification of asset allocations.解释:

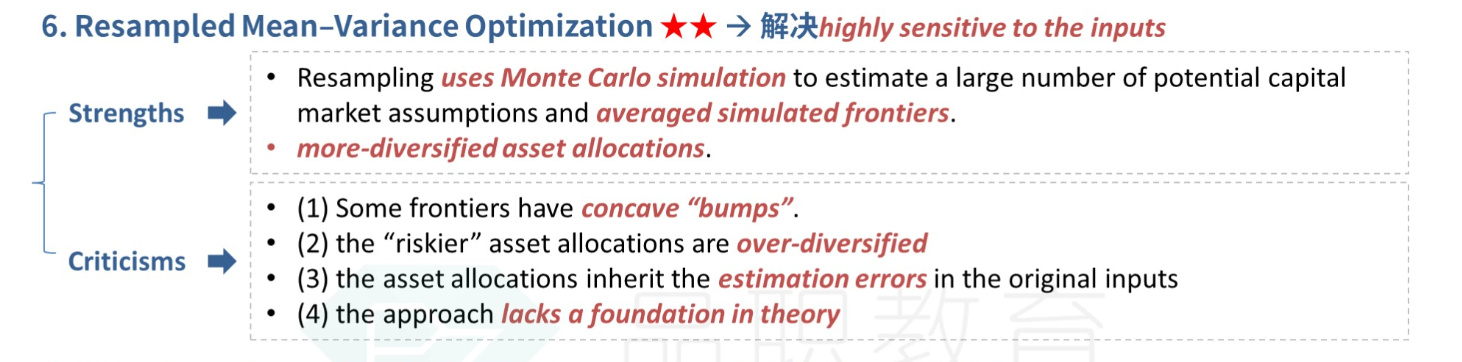

SolutionC is correct. Montgomery’s comment about the criticisms of resampling is incorrect regarding diversification of asset allocations. Risker asset allocations are over-diversified, not under-diversified. The comment is correct with regard to estimation errors because the asset allocations do inherit the estimation errors in the original inputs.

A and B are incorrect. Risker asset allocations are over-diversified, not under-diversified. However, the asset allocations do inherit the estimation errors in the original inputs.

C错哪了