NO.PZ2019120301000259

问题如下:

Question If a company has a deferred tax asset reported on its statement of financial position and the tax authorities reduce the tax rate, which of the following statements is most accurate concerning the effect of the change? The existing deferred tax asset will:选项:

A.not be affected. B.increase in value. C.decrease in value.解释:

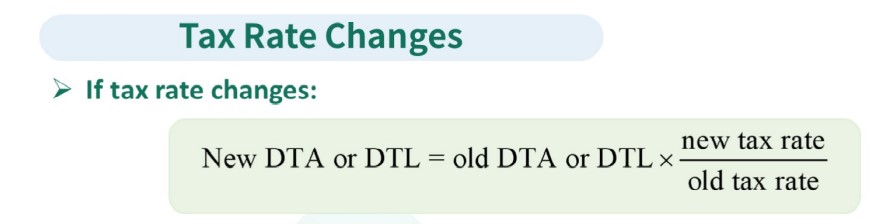

SolutionC is correct. A decrease in the tax rate will result in a decrease in the previously reported amounts of deferred tax assets. That is, the value of the future tax assets, based on the new lower rate, is reduced for offsetting future tax payments.

A is incorrect. The change would affect not only the current year’s reported income tax expense but also any amounts previously established on the balance sheet.

B is incorrect. The value of the future benefits decreases, not increases.

RT