NO.PZ2019120301000255

问题如下:

Question

The following information is available about a company:

选项:

A.$1,250.00 B.$950.00 C.$1,050.00解释:

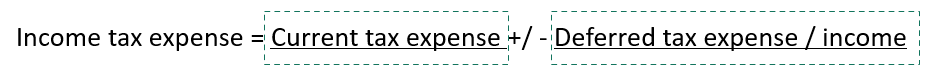

SolutionC is correct. Income tax expense reported on the income statement = Income tax payable + Net changes in the deferred tax assets and deferred tax liabilities. The change in the net deferred tax liability is a $50 increase (indicating that the income tax expense is $50 in excess of the income tax payable, or current income tax expense) and represents an increase in the expense. Therefore, the income tax expense = $1,000 + $50 = $1,050.

A is incorrect. It is the income tax payable plus the net deferred tax liability, not just the change in the net liability: $1,000 + 250 =$1,250.

B is incorrect. Incorrectly subtracts the net deferred tax liability: $950 = $1,000 – $50.

RT