NO.PZ2019120301000213

问题如下:

Question

An analyst has assembled the following information with respect to a production facility:

选项:

A.£27.

B.£32.

C.£28.

解释:

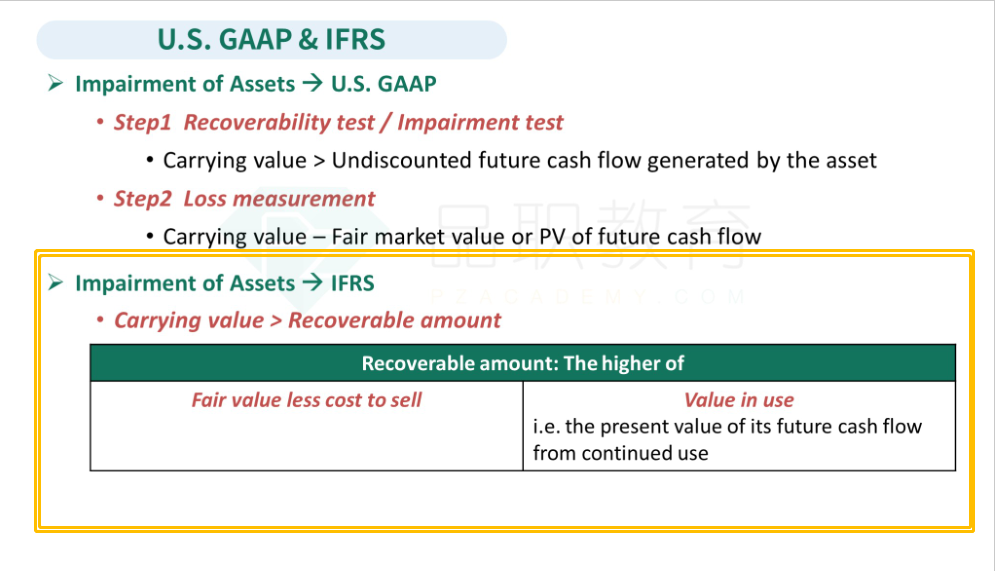

SolutionC is correct. Under IFRS, the carrying amount (132) is compared to the higher of fair value minus costs to sell (104 =105 – 1) and present value of expected future cash flows (100). The higher of the two amounts, the recoverable amount is 104; therefore, the asset is impaired and written down to that amount. The impairment loss = 132 – 104 = 28.

A is incorrect: 27,000 is the impairment under US GAAP (carrying value less fair value).

B is incorrect: 32,000 = 132,000 – 100,000 carrying value less PV CF.

ifrs里面不是cv和recoverable amount比吗 不应该是32吗。解释里面怎么是跟未折现cf比 损失是cv减折现cf啊