NO.PZ2018122701000066

问题如下:

A 2-year zero-coupon bond with a face value of USD 1,000 is currently priced at USD 952.48. The firm uses a binominal pricing model with a 1-year time step for all of its valuations. If interest rates go down over the next year, the model estimates the bond’s value to be USD 970, and if interest rates go up over the next year, the model estimates the bond’s value to be USD 950. Using the risk-neutral probabilities implied by the model, and assuming the risk-free rate of interest is 1% per year, what should be the current value of a 1-year European call option on this bond with a strike price of USD 960?

选项:

A.USD 3.96

B.USD 5.94

C.USD 6.00

D.USD 9.90

解释:

B is correct.

考点Interest Rate Tree (Binominal) Model

解析:假设价格上涨的概率为πu ,价格下跌的概率为πd =1- πu

[970*πu +950*(1-πu )]/(1+1%)=952.48,求出πu=60%,πd =40%.

对于欧式看涨期权,执行价格为960,所以C+ =max(970-960,0)=10, C- =max(950-960,0)=0.

于是C0 =(10*60%+0*40%)/(1+1%)=5.94

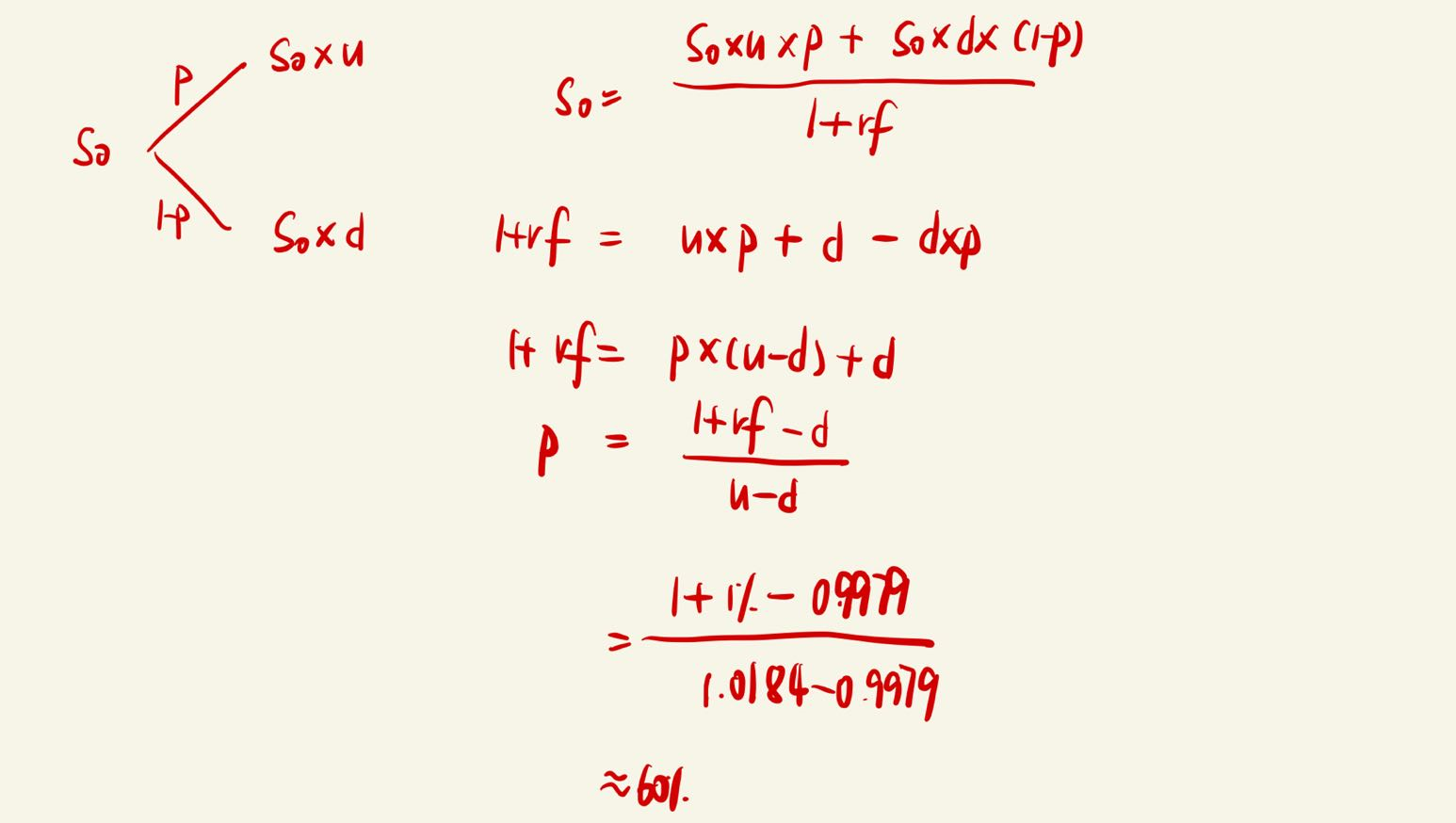

这里面的上涨概率为什么不用 u−d1+r−d