Dieter Klopp Case Scenario

SCAI is a registered investment adviser based in Nashville, Tennessee, providing investment and private wealth management advice to endowments, retirement plans, and corporations. Dieter Klopp, a portfolio manager, is meeting with analysts Nabil Salah and Lisa Suarez to discuss fixed-income investment opportunities and portfolio management strategies. Klopp presents the group with the information on spot rates shown in Exhibit 1:

Exhibit 1.

Spot Rates for Zero-Coupon Bonds

Maturity

(Years)Spot Rate12.041%22.598%32.818%42.956%53.304%

Salah is currently evaluating a corporate bond and makes the following statements:

Statement 1“The value of a bond calculated by discounting its future cash flows by their corresponding spot rates will be the same as the value obtained by discounting future cash flows by the yield-to-maturity of a bond, as long as the yield-to-maturity is some weighted average of the spot rates.”

Statement 2“Yield-to-maturity is a good estimate of the expected return on a bond assuming coupons are reinvested at the prevailing spot rates.”

Statement 3“If the yield curve remains flat during the holding period, the realized rate of return on a bond will be the same as the expected rate of return.”

Salah asks Klopp to explain the spot curve in Exhibit 1. Klopp responds that the spot rate curve in Exhibit 1 is derived from the par curve using a process called bootstrapping. The par rates are yields-to-maturity, at various maturities, for on-the-run, coupon-paying government bonds priced at par. Bootstrapping is a process of forward substitution, where successive spot rates are derived from par rates one at a time. The process begins with recognizing that the one-year spot rate is the same as the one-year par rate. The two-year spot rate, r(2), is then calculated by solving the following equation:

Par Value=2−year Par coupon

(1+(2))

+2−year Par coupon + Par value

(1+r(2))

2

.This process continues until all spot rates are derived.

Klopp then asks Suarez how the spot curve can be used in fixed-income analysis. Suarez responds, “Our expectations regarding the evolution of future spot rates compared to the forward curve allow for an evaluation of the relative value of a bond and the identification of appropriate bond trading strategies. Interest rate scenarios and corresponding appropriate strategies are outlined here”:

Scenario 1:If we expect future spot rates to be lower than current forward rates, then we should short the bond since it is likely to be overvalued.

Scenario 2:If the spot curve is expected to be above the forward curve and our expectations turn out to be correct, the bond should be purchased since the one-year return will be more than the one-year risk-free rate.

Scenario 3:If the yield curve is upward sloping and we expect spot rates to evolve as implied by the forward curve, then a strategy of buying bonds with maturities longer than the investment holding period will allow us to earn a return greater than a maturity matching strategy.

Question

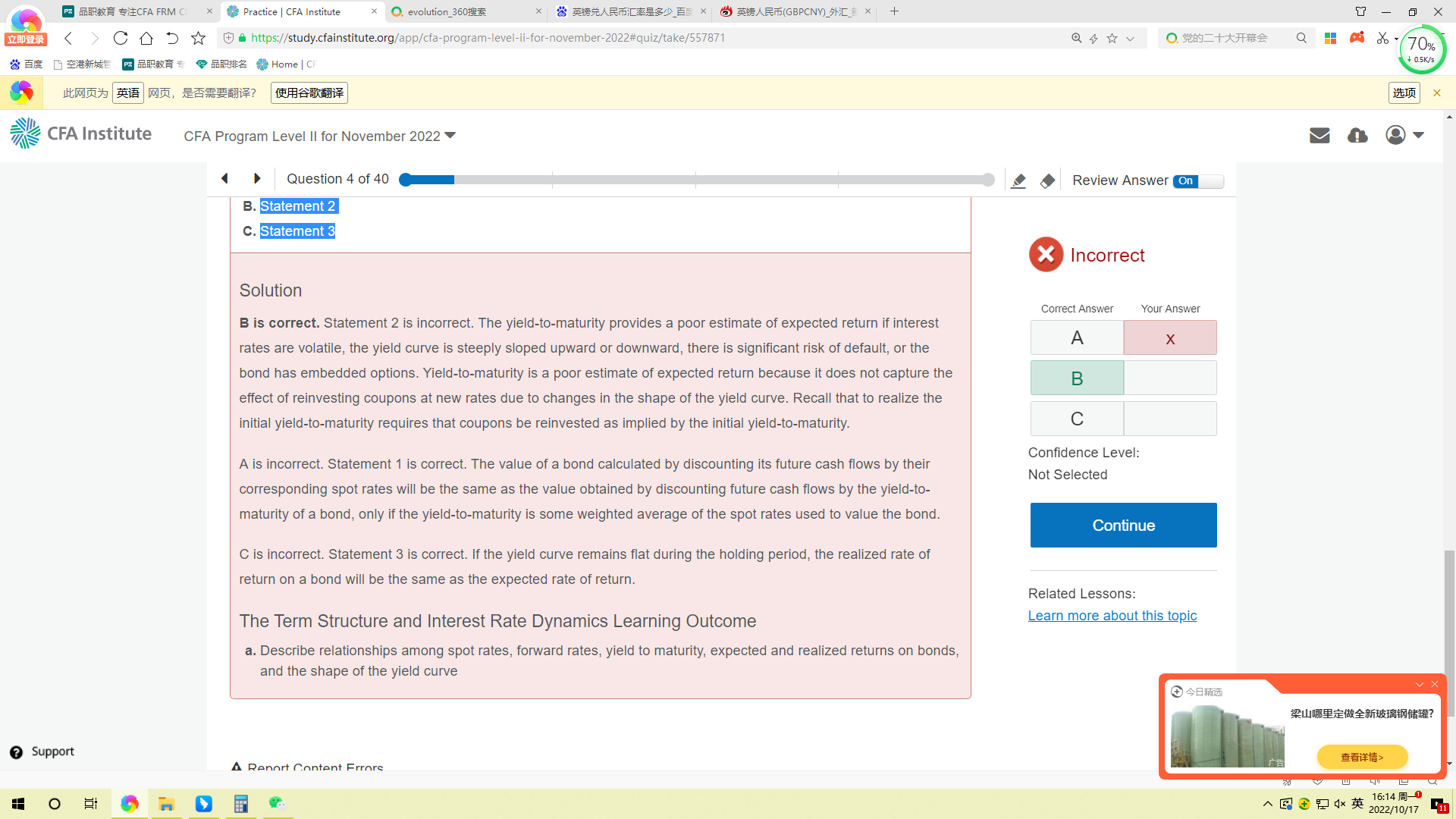

Which of Salah’s three statements is least likely correct?

- Statement 1

- Statement 2

Statement 3