NO.PZ201512300100000304

问题如下:

4. A supply side estimate of the equity risk premium as presented by The Ibbotson Chen earnings model is closest to:

选项:

A.3.2 percent.

B.4.0 percent.

C.4.3 percent.

解释:

C is correct.

According to this model, the equity risk premium is

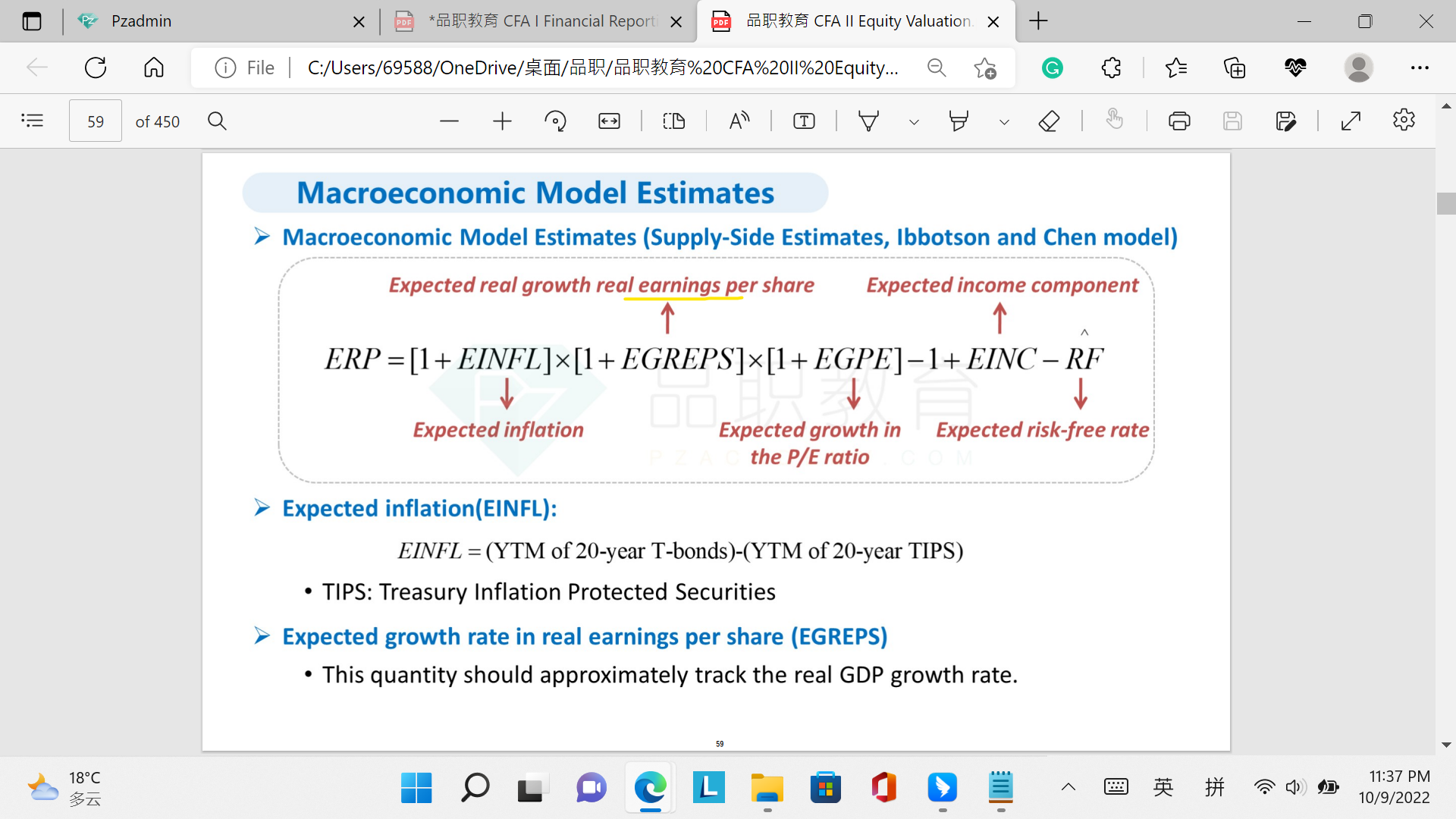

Here: Equity risk premium = {[(1 + EINFL)(1 + EGREPS)(1 + EGPE) − 1.0] + EINC}−Expected risk-free return

EINFL = 4 percent per year (long-term forecast of inflation)

EGREPS = 5 percent per year (growth in real earnings)

EGPE = 1 percent per year (growth in market P/E ratio)

EINC = 1 percent per year (dividend yield or the income portion)

Risk-free return = 7 percent per year (for 10-year maturities)

By substitution, we get:{[(1.04)(1.05)(1.01) − 1.0] + 0.01} − 0.07 = 0.113 − 0.07 = 0.043 or 4.3 percent.

想问一下老师,这里的Risk-free return = 7 percent per year 为什么要用 10-year maturities?在Supply Side Estimates里,Rf是要用长期的吗?

谢谢!