NO.PZ2018122701000061

问题如下:

A bond portfolio consists of five bonds:

Bond 1: 5%, annual-pay bond with a 10-year maturity and a yield of 4.5%.

Bond 2: 5%, semiannual-pay bond with a 10-year maturity and a yield of 4.5%.

Bond 3: A zero-coupon bond with a 10-year maturity and a yield of 4.5%.

Bond 4: 4%, semiannual-pay bond with a 10-year maturity and a yield of 4.5%.

Bond 5: 5%, annual-pay bond with a 10-year maturity and a yield of 5.5%.

Which of the following statements about these bonds is Correct?

选项:

A. Bond 1 has a shorter duration than Bond 2.

B. The Macaulay duration of Bond 3 is five years.

C. Bond 4 has a shorter duration than Bond 2.

D. The DV01 of Bond 5 is lower than the DV01 of Bond 1.

解释:

D is correct.

考点Measures of Pricing Sensitivity Based on Parallel Yield Shifts

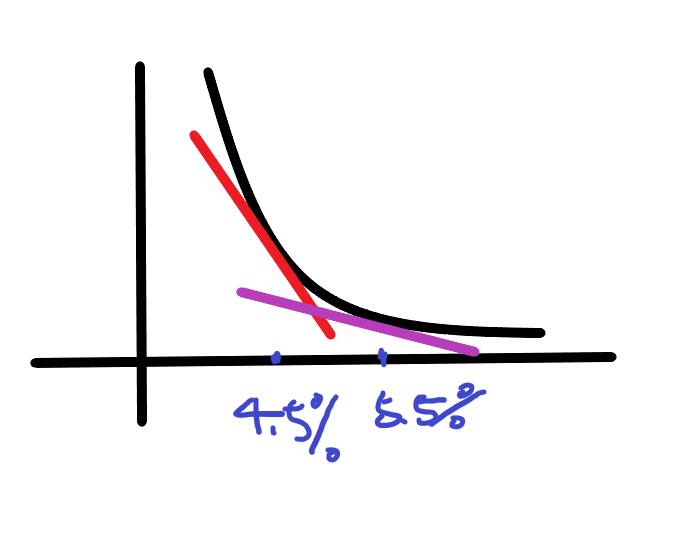

解析Increasing the yield will lower the DV01. Since Bond 5 has a higher yield than Bond 1, it must have a lower DV01. Choice B is incorrect. The Macaulay duration of a zero-coupon bond will be equal to its maturity Choices A and C are incorrect. All else equal, a semiannual-pay bond will have a shorter duration than an annual-pay bond, so Bond 2 has a shorter duration than Bond 1. A premium bond will have a shorter duration than a discount bond, so Bond 2 will have a shorter duration than Bond 4.

老师解析的第一句话怎么理解?DV01不是衡量利率每变动1bp债券价格的变化百分比吗?那和市场利率如何变化好像没有关系