NO.PZ2016021706000031

问题如下:

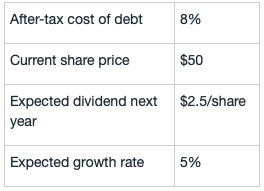

Adam Company is planning to invest in a project with a $100,000 initial cash outlay. This new project is expected to generate cash flows of $30,000 every year in the next ten years. The flowing is the information of Adam company:

Adam Company will finance the project with a debt-to-equity ratio of 1.5. The dollar amount of flotation costs is $3000 for the equity of this project.

If floatation costs are incorporated as an adjustment to the initial-period cash flows, what's the NPV for the project?

选项:

A.

$90,039.

B.

$91,236.

C.

$100,030.

解释:

B is correct.

Re = 2.5/50+ 0.05= 10%

D/E=1.5, Wd=60%, We=40%

WACC = 0.60*0.08 + 0.40*0.1 = 8.8%

N=10, I/Y=8.8, PMT=30000, FV=0, CPT PV=194236.275

NPV = -$103000+$194236.275 = $91236.275.

老师我想问一问,这道题能不能用计算机cf的功能来算出来,只不过是CF0是10300,剩下的I是Wacc这样,谢谢