NO.PZ2019120301000251

问题如下:

A company’s provision for income taxes resulted in effective tax rates attributable to loss from continuing operations before cumulative effect of change in accounting principles that varied from the statutory federal income tax rate of 34 percent, as summarized in the table below.

选项:

A.decreased prospect for future profitability. B.increased prospects for future profitability. C.assets being carried at a higher value than their tax base.解释:

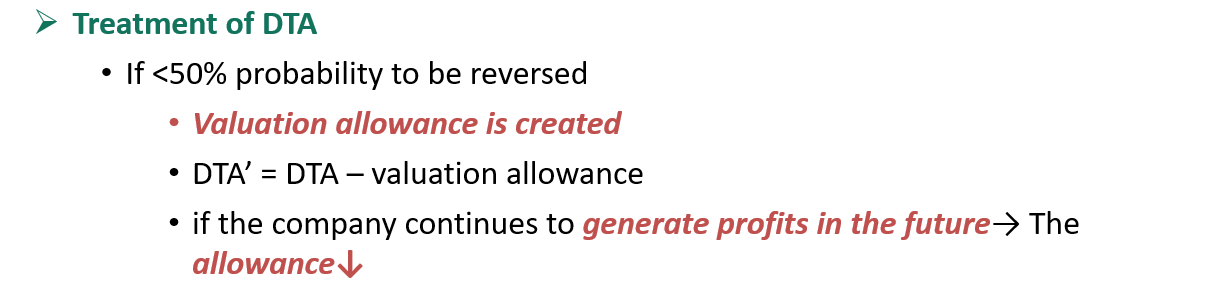

SolutionB is correct. Over the three-year period, changes in the valuation allowance reduced cumulative income taxes by $1,670,000. The reductions to the valuation allowance were a result of the company being “more likely than not” to earn sufficient taxable income to offset the deferred tax assets.

请老师解释一下这道题的题干和表格里涉及的内容,以及解题思路?能不能把有这个题干的题目的偶讲一遍