NO.PZ201809170300000206

问题如下:

Gurmeet Singh, an equity portfolio manager at a wealth management company, meets with junior research analyst Cindy Ho to discuss potential investments in three companies: Sienna Limited, Colanari Manufacturing, and Bern Pharmaceutical.

Singh and Ho review key financial data from Sienna’s most recent annual report, which are presented in Exhibits 1 and 2, to assess the company’s ability to generate free cash flow.

Exhibit 1: Selected Data from Sienna Limited’s Statement of Income for the Year Ended 31 December 2016 (Amounts in Millions of Euros)

Exhibit 2: Sienna Limited’s Statement of Cash Flows for the Year Ended 31 December 2016 (Amounts in Millions of Euros)

Singh and Ho also discuss the impact of dividends, share repurchases, and leverage on Sienna’s free cash flow. Ho tells Singh the following:

Statement 1 Changes in leverage do not impact free cash flow to equity.

Statement 2 Transactions between the company and its shareholders, such as the payment of dividends or share repurchases, do affect free cash flow.

Singh and Ho next analyze Colanari. Last year, Colanari had FCFF of 140 million. Singh instructs Ho to perform a FCFF sensitivity analysis of Colanari’s firm value using the three sets of estimates presented in Exhibit 3. In her analysis, Ho assumes a tax rate of 35% and a stable capital structure of 30% debt and 70% equity.

Exhibit 3:.Sensitivity Analysis for Colanari Valuation

Finally, Singh and Ho analyze Bern. Selected financial information on Bern is presented in Exhibit 4.

Exhibit 4:.Selected Financial Data on Bern Pharmaceutical

Singh notes that Bern has two new drugs that are currently in clinical trials awaiting regulatory approval. In addition to its operating assets, Bern owns a parcel of land from a decommissioned manufacturing facility with a current market value of 50 million that is being held for investment. Singh and Ho elect to value Bern under two scenarios:

Scenario 1 Value Bern assuming the two new drugs receive regulatory approval. In this scenario, FCFF is forecast to grow at 4.5% into perpetuity.

Scenario 2 Value Bern assuming the two new drugs do not receive regulatory approval. In this scenario, FCFF is forecast using a stable growth in FCFF of 1.5% for the next three years and then 0.75% thereafter into perpetuity.

Based on Exhibit 4, Singh and Ho should conclude that under Scenario 2, shares of Bern are:

选项:

A.

undervalued.

B.

fairly valued.

C.

overvalued.

解释:

A is correct. The total market value of the firm is the sum of the debt, preferred stock, and common stock market values: 15,400 + 4,000 + 18,100 = 37,500 million.

WACC = [wd × rd(1 Tax rate)] + (wp × rp) + (we × re).

= [(15,400/37,500)(0.060)(1 0.269] + (4,000/37,500)(0.055) + (18,100/37,500)(0.11) = 7.70%.

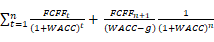

Under the assumption that Bern has a low growth rate because it did not receive regulatory approval for its new drugs, the value of Bern can be analyzed using a two-stage valuation model.

Company

value =

The terminal value at the end of Year 3 is TV3 = FCFF4/(WACC g4).

TV3 = 3,398.66/(0.0770 – 0.0075) = €48,901.58 million.

The total value of operating assets = (3,040.37 + 2,865.42 + 2,700.53) + 48,901.58/(1 + 0.0770)3 = 8,606.32 + 39,144.95 = 47,751.27

Value of Bern’s common stock = Value of operating assets + Value of non-operating assets – Market value of debt – Preferred stock = 47,751.27 + 50.00 – 15,400 – 4,000 = €28,401.27

Since

the current market value of Bern’s common stock (18,100 million) is less than the

estimated value (28,401.27 million), the shares are

undervalued.

如题............