NO.PZ2018111303000015

问题如下:

Fabian, CFA, work on the Equity investment company, Fabian is preparing a research report on PZ company, listed in HK and complies with IFRS 9. She collected information of three fixed income investments from PZ’s year end 2019 financial report (assume cost=par value):

If Angle PD had been classified as FVOCI, the reported interest income would be:

选项:

A.higher

B.the same

C.lower

解释:

B is correct.

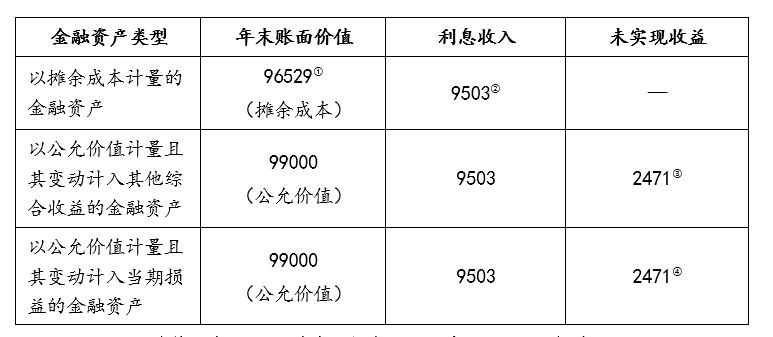

考点:Financial asset 的会计计量

解析:

平价发行债券没有摊销问题,interest income就等于收到的coupon payment,不管分类为amortized资产还是FVOCI,interest income都是一样的。

我的推导过程是这样的,还请告知一下哪里错了

int=期初的carrying value×市场利率market interest rate

carry value取决于使用哪种方式记账,其中:

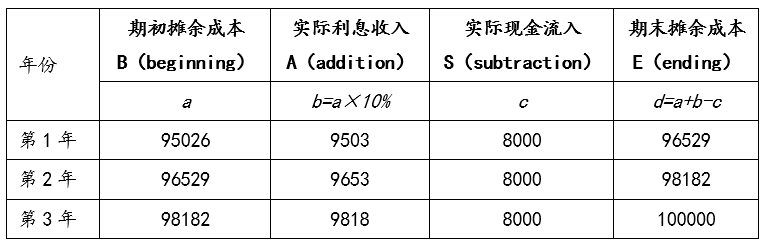

(1)amortized cost取决于BASE法则(期末=期初+int-coupon);

(2)FVOCI取决于FV;

(3)FVPL取决于FV

所以,当记账方式调整时,carrying value改变了,所以int也改变了。