NO.PZ201710200100000205

问题如下:

June Withers is analyzing four stocks in the processed food industry as of 31 December 2017. All stocks pay a dividend at the end of each year.

Ukon Corporation

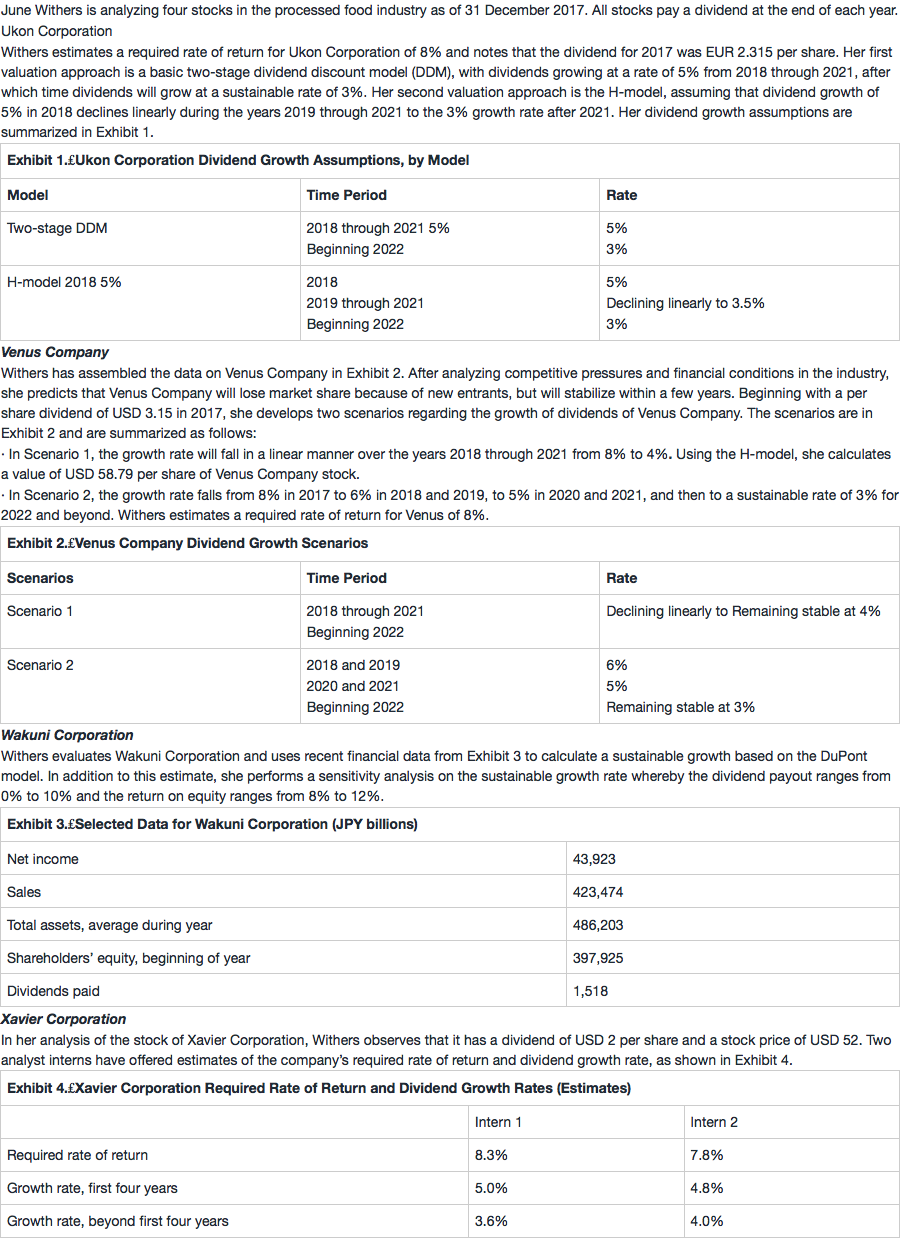

Withers estimates a required rate of return for Ukon Corporation of 8% and notes that the dividend for 2017 was EUR 2.315 per share. Her first valuation approach is a basic two-stage dividend discount model (DDM), with dividends growing at a rate of 5% from 2018 through 2021, after which time dividends will grow at a sustainable rate of 3%. Her second valuation approach is the H-model, assuming that dividend growth of 5% in 2018 declines linearly during the years 2019 through 2021 to the 3% growth rate after 2021. Her dividend growth assumptions are summarized in Exhibit 1.

Venus Company

Withers has assembled the data on Venus Company in Exhibit 2. After analyzing competitive pressures and financial conditions in the industry, she predicts that Venus Company will lose market share because of new entrants, but will stabilize within a few years. Beginning with a per share dividend of USD 3.15 in 2017, she develops two scenarios regarding the growth of dividends of Venus Company. The scenarios are in Exhibit 2 and are summarized as follows:

· In Scenario 1, the growth rate will fall in a linear manner over the years 2018 through 2021 from 8% to 4%. Using the H-model, she calculates a value of USD 58.79 per share of Venus Company stock.

· In Scenario 2, the growth rate falls from 8% in 2017 to 6% in 2018 and 2019, to 5% in 2020 and 2021, and then to a sustainable rate of 3% for 2022 and beyond. Withers estimates a required rate of return for Venus of 8%.

Wakuni Corporation

Withers evaluates Wakuni Corporation and uses recent financial data from Exhibit 3 to calculate a sustainable growth based on the DuPont model. In addition to this estimate, she performs a sensitivity analysis on the sustainable growth rate whereby the dividend payout ranges from 0% to 10% and the return on equity ranges from 8% to 12%.

Xavier Corporation

In her analysis of the stock of Xavier Corporation, Withers observes that it has a dividend of USD 2 per share and a stock price of USD 52. Two analyst interns have offered estimates of the company’s required rate of return and dividend growth rate, as shown in Exhibit 4.

5. Under Scenario 2 and based on Exhibit 2, Withers estimates that the value of the Venus Company stock to be closest to:

选项:

A.USD 69.73.

B.USD 71.03.

C.USD 72.98.

解释:

B is correct based on the present value of forecasted dividends. The dividend at the end of 2017, based on case material, is USD 3.15 per share.

要把3.15加上吗?为什么?