NO.PZ2018103102000064

问题如下:

Jacques prepares to update the valuation of TMT. The company’s expected ROE in 2017 is 34.5% but it is assumed that the firm’s ROE will slowly decline towards the cost of equity thereafter. As of the beginning of 2015, based upon the information in the below table, use the multistage-stage residual income (RI) model to determine the intrinsic value of the equity of TMT. The intrinsic value per share is closest to:

选项:

A.22.72.

B.14.97.

C.78.81.

解释:

B is correct.

考点:RI

解析:B是正确的。第一步是计算2015 - 2017年的每股剩余收益:

第二步是计算终值的现值:

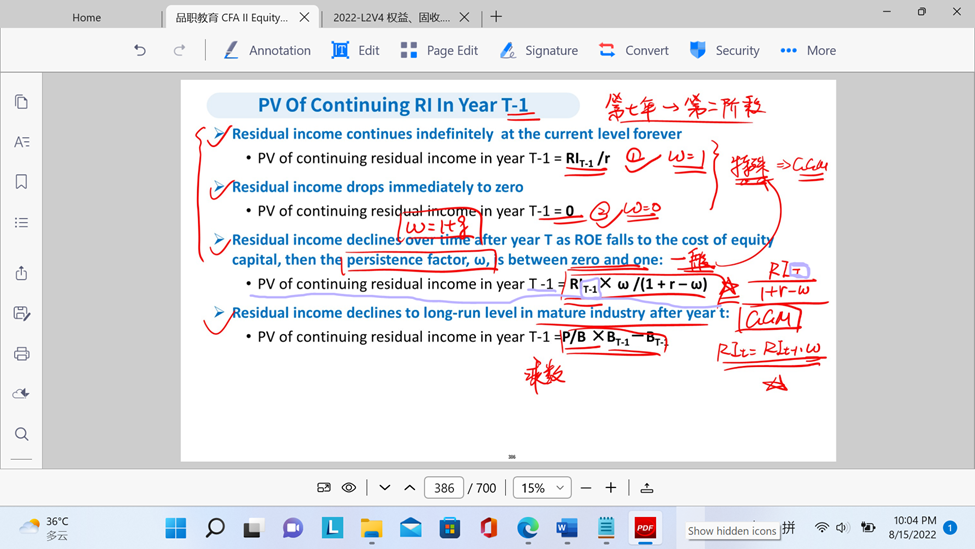

PV of Terminal Value =1.88/(1+0.08-0.85)(1.08)2=7

那么每股的内在价值就是: V0=5+1.6/(1.080)+1.74/(1.08)2+7=14.97

请问用1.88计算终值的时候,分子上不需要用1.88*persistent factor吗,我看老师讲义的公式上分子上RI*persistent factor