NO.PZ2021102201000046

问题如下:

Kinetic Corporation is considering acquiring High Tech Systems. Jim Smith, the vice president of finance at Kinetic, has been assigned the task of estimating a fair acquisition price for High Tech. Smith is aware of several approaches that could be used for this purpose. He plans to estimate the acquisition price based on each of these approaches, and has collected or estimated the necessary financial data.

While discussing his analysis with a colleague, Smith makes two comments. Smith’s first comment is: "If there were a pre-announcement run-up in Quadrant’s price because of speculation, the takeover premium should be computed based on the price prior to the run-up." His second comment is: "Because the comparable transaction approach is based on the acquisition price, the takeover premium is implicitly recognized in this approach."

Are Smith’s two comments about his analysis correct?

选项:

A.Both of his comments are correct

Both of his comments are incorrect

His first comment is correct, and his second comment is incorrect

解释:

A is correct. Both of Smith’s statements are correct. If there was a pre-announcement run-up in Quadrant’s price because of speculation, the takeover premium should be computed based on the price prior to the run-up.

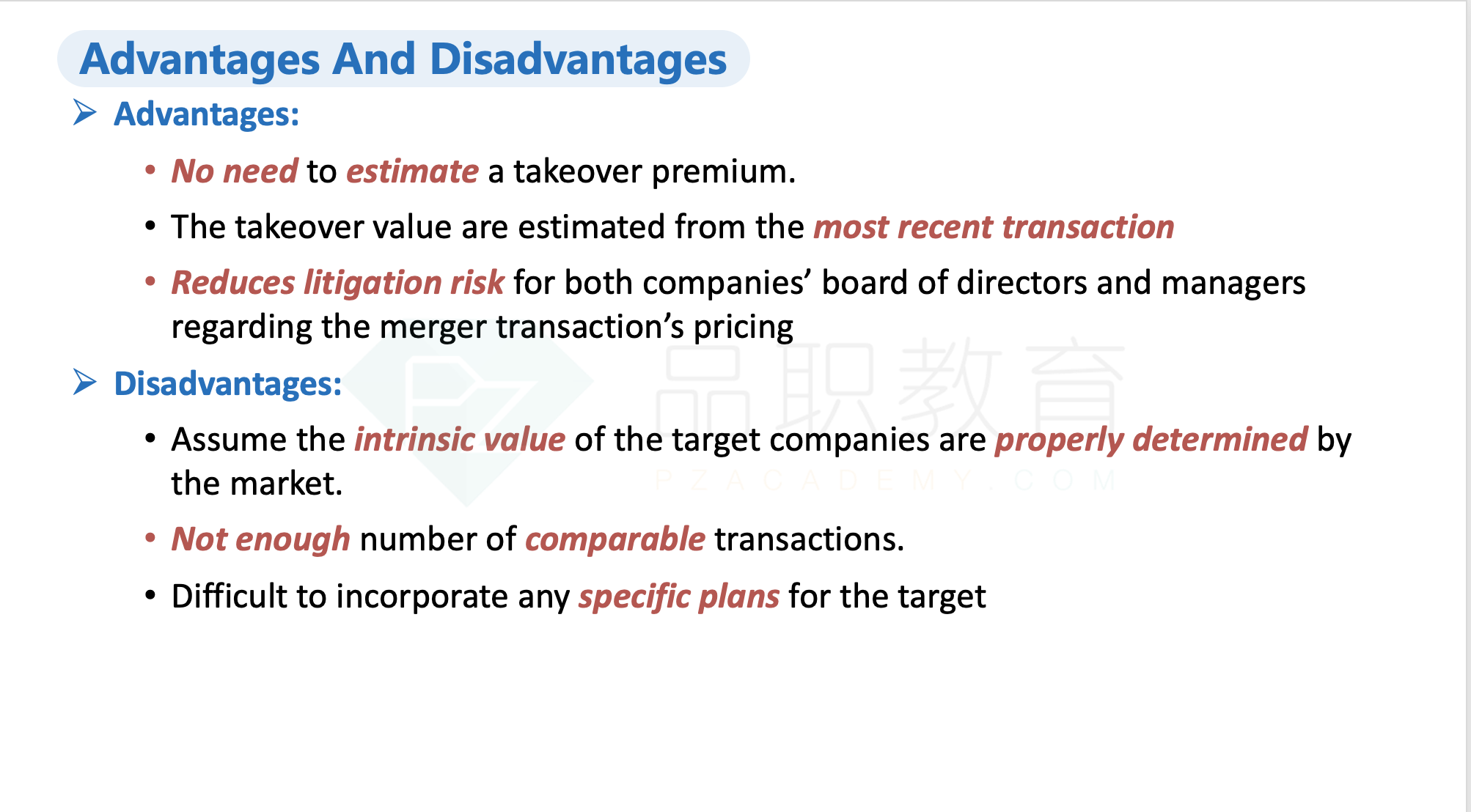

Because the comparable transaction approach is based on the acquisition price, the takeover premium is implicitly recognized in this approach.

如题 谢谢