NO.PZ2018091705000111

问题如下:

Sharfepto Zik, a private wealth manager, is meeting with a client, Garbanzo Patel, in order to create an investment policy statement (IPS) for Patel’s upcoming retirement. Patel estimates that he will require €200,000 per year, with annual increases for inflation, during retirement. Patel’s primary spending goals during retirement are to provide for his family’s needs and maintain his retirement lifestyle. His secondary goals are to fund his philanthropic activities and leave a significant inheritance to his children.

During his retirement, Patel will receive union pension payments of €50,000 per year with annual increases for inflation. In his spare time, Patel runs a small business that provides him with an annual income of €120,000 and is valued at €1 million. He will continue running his business during retirement.

Patel holds a portfolio of securities valued at approximately €4_million. The portfolio primarily contains dividend- paying stocks and interest- bearing bonds. Patel has reinvested all these distributions back into his portfolio but anticipates that after retirement he may need to use some of the distributions to fund his expenses.

Patel plans to buy a vacation home in three years. His budget for the vacation home is approximately €1.4_million. Patel has not decided yet how he will fund this purchase.

Prepare the Investment Objectives section of Patel’s IPS.

选项:

解释:

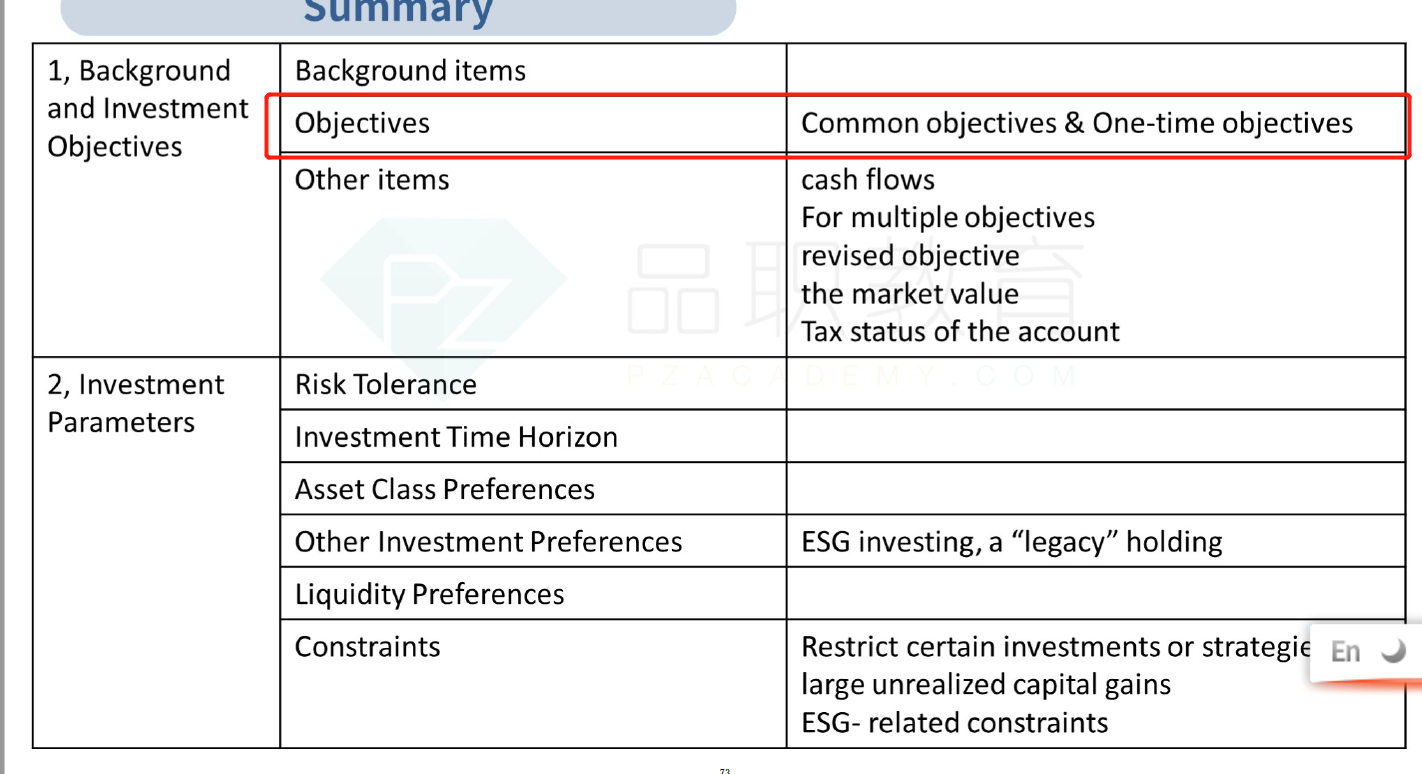

Investment Objectives:

■● Purpose: Support Patel’s lifestyle in retirement (higher priority), provide for family’s needs (higher priority), fund philanthropic activities (lower priority), provide inheritance for children (lower priority)

■● Anticipated annual need: €200,000, with annual increases for inflation

■● Annual need met with: Income from small business (approx. €120,000), pension (€50,000 with annual inflation increases), portfolio distributions

■● Intent to purchase of €1.4 million vacation home in three years

■● Zik should assist in quantifying philanthropic and bequest goals and determining how to fund the vacation home purchase.

The purpose of this portfolio is to support Garbanzo Patel’s lifestyle in retirement, to provide for his family’s needs, to fund his philanthropic activities, and to provide an inheritance for his children. Patel’s primary objective is to provide for his family’s needs and support his lifestyle during his retirement. The philanthropic and bequest objectives are lower priorities.

To meet all his objectives, Patel anticipates needing €200,000 per year, with annual increases for inflation. His cash needs will be primarily satisfied through income from his small business of approximately €120,000 per year and his union pension payments of €50,000 per year. The pension payments will increase annually for inflation. Any remaining cash needs will be satisfied by taking distributions from his portfolio.

Patel also intends to purchase a vacation home in three years and plans to pay approximately €1.4 million.

Patel has not articulated specific amounts for his philanthropic activities or his children’s inheritances. Zik should work with Patel to quantify his philanthropic and bequest goals and to decide on the best way to fund the purchase of his vacation home.

如题