NO.PZ2018062007000054

问题如下:

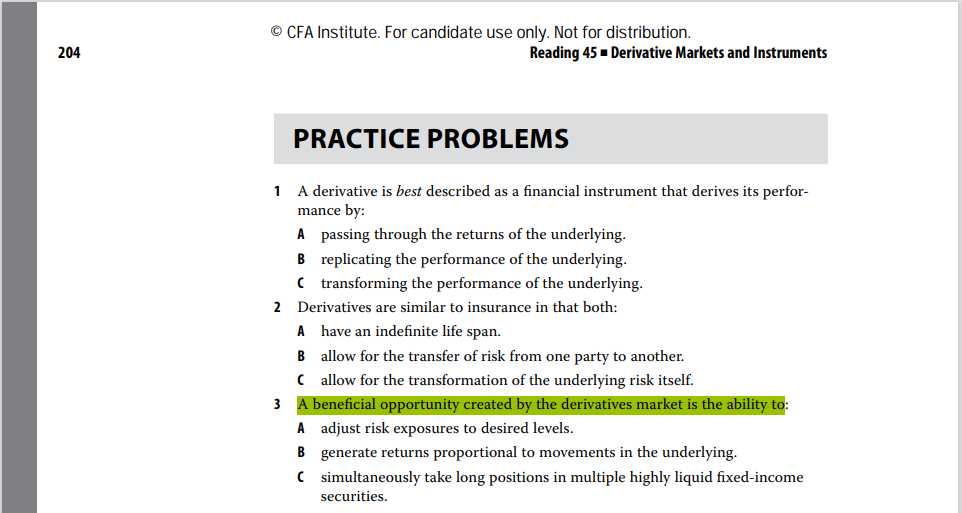

A beneficial opportunity created by the derivatives market is the ability to:

选项:

A.

adjust risk exposures to desired levels.

B.

generate returns proportional to movements in the underlying.

C.

simultaneously take long positions in multiple highly liquid fixed- income securities.

解释:

A is correct. Derivatives allow market participants to practice more effective risk management, a process by which an organization, or individual, defines the level of risk it wishes to take, measures the level of risk it is taking, and adjusts the latter to equal the former. B is incorrect because derivatives are characterized by a relatively high degree of leverage, meaning that participants in derivatives transactions usually have to invest only a small amount, as opposed to a large amount, of their own capital relative to the value of the underlying. This allows participants to generate returns that are disproportional, as opposed to proportional, to movements in the underlying. C is incorrect because derivatives are not needed to copy strategies that can be implemented with the underlying on a standalone basis. Rather, derivatives can be used to create strategies that cannot be implemented with the underlying alone. Simultaneously taking long positions in multiple highly liquid fixed- income securities is a strategy that can be implemented with the underlying securities on a standalone basis.

中文解析:

A选项,衍生品给了市场参与者提供了更多的可以有效管理风险的方式,正确;

B选项,衍生品会成比例地获得标的资产的收益,重点词是propotional,而衍生品的特点是可以使用杠杆,对应的是dispropotional。

C选项,错误是因为衍生品的优点不是复制市场中已有的资产或组合,而是可以提供与现货市场中没有的交易机会。

想问问这道题在书上哪块呢,