NO.PZ201803130100000201

问题如下:

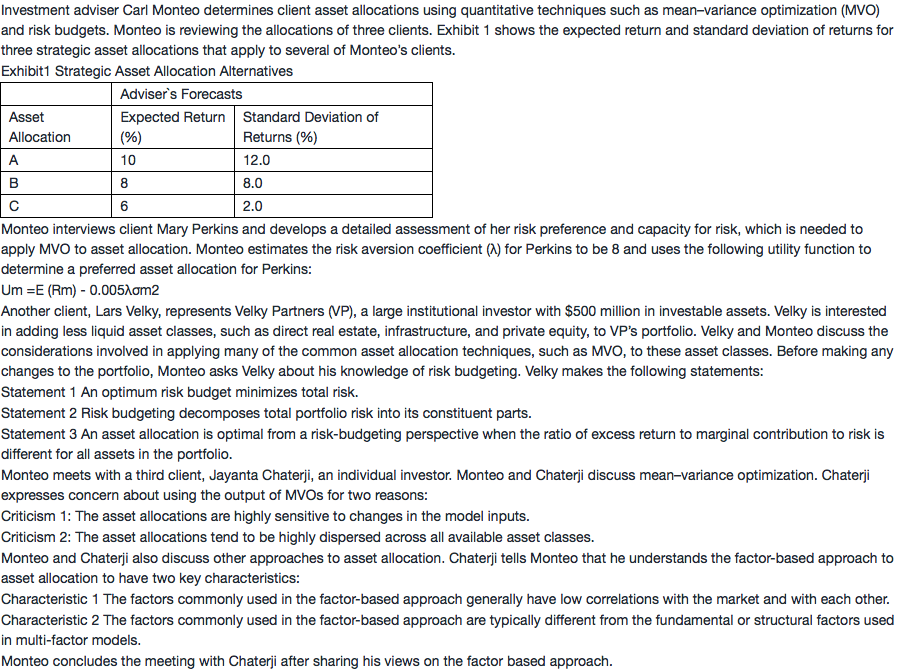

Based on Exhibit 1 and the risk aversion coefficient, the preferred asset allocation for Perkins is:

选项:

A.Asset Allocation A.

B.Asset Allocation B.

C.Asset Allocation C.

解释:

C is correct.

The risk aversion coefficient (λ) for Mary Perkins is 8. The utility of each asset allocation is calculated as follows:

Asset Allocation A:UA = 10.0% – 0.005(8)(12%)2= 4.24%

Asset Allocation B:UB = 8.0% – 0.005(8)(8%)2= 5.44%

Asset Allocation C:UC = 6.0% – 0.005(8)(2%)2= 5.84%

Therefore, the preferred strategic allocation is Asset Allocation C, which generates the highest utility given Perkins’s level of risk aversion.

我记得是说不管怎么样都选sharp ratio最大的。然后其他的可以用现金来调整。但是这题为什么还要计算那个公式?还是我记错了?