NO.PZ2017092702000070

问题如下:

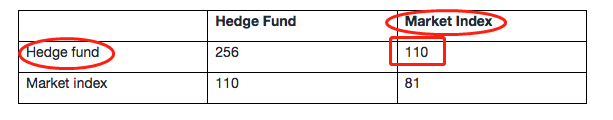

An analyst develops the following covariance matrix of returns:

The correlation of returns between the hedge fund and the market index is closest to:

选项:

A.

0.005.

B.

0.073.

C.

0.764.

解释:

C is correct.

The correlation between two random variables Ri and Rj is defined as ρ(Ri,Rj) = Cov(Ri,Rj)/σ(Ri)σ(Rj). Using the subscript i to represent hedge funds and the subscript j to represent the market index, the standard deviations are σ(Ri) = 2561/2 = 16 and σ(Rj) = 811/2 = 9. Thus, ρ(Ri,Rj) = Cov(Ri,Rj)/σ(Ri) σ(Rj) = 110/(16 × 9) = 0.764

hedge fund的return的方差就是256,标准差即为16;

Market index的return的方差就是81,标准差就是9。

右上角的110是market index和hedge fund的covariance,所以都相同均为110。

然后就正常代入ρ的公式:

ρ=cov/(σ hedge fund * σ market index)=110/(16*9)=0.764。

老师,为什么cov等于110?看解释没看明白,请老师详细解释下,谢谢。